Britain’s plan for growth is dead for now.

Prime Minister Rishi Sunak’s authorities is focusing as a substitute on filling a deep gap within the public funds brought on by rising rates of interest, rocketing inflation and a probable recession, all of which have exhausted the assets accessible for exciting the financial system, an official with information of the matter mentioned.

That conclusion signifies the size of the job dealing with Sunak and his Chancellor of the Exchequer Jeremy Hunt as they draw up the Treasury’s autumn financial assertion due on November 17. While Liz Truss emphasised growth as the first ambition throughout her few weeks in workplace, Sunak and Hunt are having to agency up investor confidence by displaying how they are going to repay the UK’s burgeoning debt load.

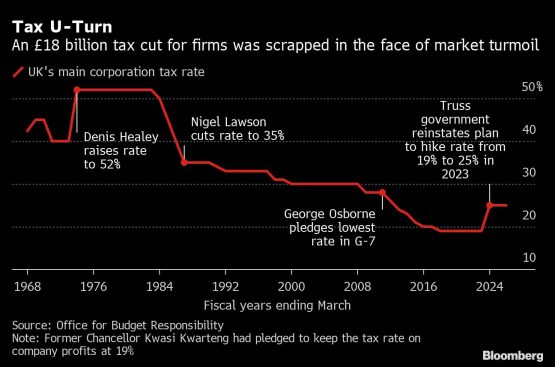

It’s one of many brutal ironies of Truss’s tenure. Her “growth plan” providing £45 billion ($52 billion) of unfunded tax cuts so spooked traders and broken the UK’s fiscal credibility that it has killed off any rapid hopes of delivering long-term measures to bolster financial efficiency that the UK so desperately wants.

“The immediate focus needs to be on landing the fiscal consolidation,” mentioned Tim Pitt, a former Treasury adviser now accomplice at Flint Global. “A clear, considered growth plan is essential, but it might make more sense to that as part of a budget in the spring.”

On Friday, individuals acquainted with the federal government’s pondering mentioned the Treasury is in search of tax will increase and spending cuts totaling as a lot as £50 billion. That would add to headwinds the financial system faces on the similar time shoppers are struggling the tightest cost-of-living squeeze in a long time and the Bank of England plans the quickest will increase in borrowing prices in 33 years.

Jeremy Hunt, UK chancellor of the exchequer.

Early steps by Hunt to reverse Truss’s package deal have restored some calm to monetary markets, bringing down rates of interest in monetary markets and doubtlessly saving as much as £15 billion a yr in debt service prices from the height of the market panic a couple of weeks in the past.

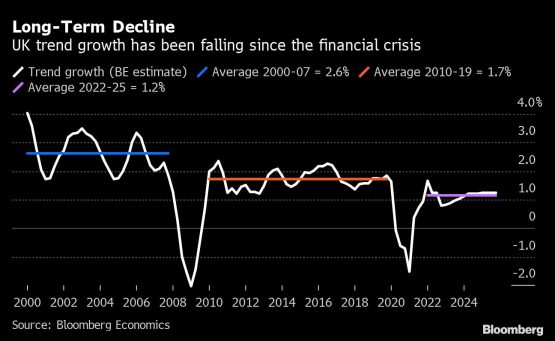

But that also leaves £35 billion wanted, a large sum for an financial system that’s sputtering. It marks a consolidation of about 1.5% of gross home product, equal to roughly a sixth of the price range squeeze between 2010 and 2018, the years of austerity after the monetary disaster. For now, rising the financial system is now a second-order concern.

As chancellor in March, Sunak signaled that his flagship growth coverage can be a serious new tax reduction to spice up enterprise funding. He can now not afford it, in response to one authorities official, who requested to not be named as a result of price range discussions are nonetheless ongoing. That will imply the UK’s company tax charge rises to 25%, probably the most in a decade, from 19%, with little offsetting incentive for corporations to take a position.

Hunt is prone to promise deregulation, together with financial-services reform, to drive longer-term output, however there can be no cash for funding now nor will there be political backing for higher migration to handle the UK’s power labor shortages. According to the Office for Budget Responsibility, lifting internet immigration by 75 000 a yr would elevate long-term development growth from 1.4% to 1.6%, nonetheless properly beneath the degrees prevailing in earlier a long time.

Sunak mentioned “mistakes were made” below Truss, and as a end result the federal government will now must take “difficult decisions” on tax and spending to fill the remaining gap.

The Bank of England might be able to ship a little bit of assist. The central financial institution on Thursday is anticipated by traders and economists to boost rates of interest three-quarters of a proportion level to three% and forecast a deeper recession resulting from “materially higher” charges than it projected in August, in response to Nomura’s European economist George Buckley.

If its forecasts present inflation falling beneath goal throughout the coming recession, traders might reply by decreasing market charges. That would cut back debt-servicing prices and spare the federal government some austerity.

BOE officers have already got signaled some softening of their hawkishness on charge rises. Deputy Governor Ben Broadbent earlier this month questioned whether or not “official interest rates have to rise by quite as much as currently priced in financial markets.” Extrapolating from the OBR’s rule-of-thumb calculations on the drop in market charges since then, his feedback alone might save the Treasury £5 billion.

Even so, there can be no escaping laborious choices. Among the choices on tax are:

- Expanding the windfall tax on North Sea oil and fuel producers to all power suppliers. Shell Plc’s chief government conceded this week there was a case for windfall taxes as quarterly earnings doubled to £8 billion. Could elevate £5-£10 billion

- A financial institution tax to recuperate the revenue lenders are making from the mixture of upper rates of interest and the inventory of cash created via quantitative easing. Could elevate £2-£5 billion.

- Reintroducing the Health and Social Care Levy in 2024, which Sunak introduced earlier this yr and Truss scrapped. Potential: £15 billion.

- A flat charge of pensions tax reduction of 25%. It would penalize higher-rate earners, who amassed financial savings throughout the pandemic and luxuriate in 40% reduction, however encourage lower-rate earners on 20% reduction to save lots of. Could elevate £5 billion.

- Increase capital-gains tax charges nearer to ranges charged for earnings. Could elevate £3-£4 billion.

On spending, the choices accessible embrace:

- Reducing public funding initiatives to previous annual averages of two% of GDP. According to the Institute for Fiscal Studies, that might save £14 billion.

- Freezing the overseas help price range at 0.5% of GDP as a substitute of boosting it as deliberate to 0.7% in 2024/25. Could save £5 billion.

- Benefits are below scrutiny regardless of the price of residing disaster and Hunt’s pledge to be “compassionate.” The authorities has not dominated out suspending the state pension triple lock. Uprating each the state pension and working-age advantages in keeping with earnings quite than costs would save £13 billion. Excluding pensions would nonetheless save round £7 billion.

Unprotected authorities departments — these exterior well being and schooling — are below strain to seek out financial savings. But they’re already having to chop between 8% and 10% of their budgets simply to stay to present spending limits.

The present limits on money spending have been set in 2021 earlier than inflation and wages took off and drove up day-to-day prices. Making deeper cuts would threat a deterioration in public providers already struggling after years of austerity.

Hunt might resort to accounting tips. The authorities might resolve to restrict departmental spending will increase after the present interval ends in 2024 to 1% greater than inflation. That can be beneath the conference of accelerating budgets in keeping with GDP, and will save as much as £10 billion.

Similarly, the four-year freeze on income-tax thresholds could also be prolonged two extra years past 2026. Doing so would save £2 billion yearly, in response to Resolution Foundation analysis director James Smith. Yet it will fly within the face of the federal government’s said intention of decreasing the UK’s long-term tax burden.

© 2022 Bloomberg