The JSE-listed gold shares have outperformed their global peers as their discounts have narrowed to unwarranted levels.

We believe that AngloGold and Gold Fields are overvalued at current and normal gold prices.

In July 2021, we wrote about the gold position that was held across many of Coronation’s client portfolios. A year later, we sold down the bulk of this position to increase our exposure to well-priced global equities.

Listen: Gold: What can we expect for the remainder of 2023?

Up until the beginning of November 2022, this proved to be the right decision. However, soon after, gold shares rallied, indicating that we had sold too early. Nonetheless, we think that the rally has been meaningfully overdone and we don’t see value in JSE-listed gold equities at these levels.

Our initial thesis behind the investment in gold shares was that the pervasive money-printing central bank balance sheet expansion and novel fiscal policies of 2020/2021 provided an environment that lent itself to sustained high gold prices. In addition, we believed we were seeing positive operational and capital allocation improvements from AngloGold and Gold Fields, which had the potential to unlock attractive through-the-cycle returns.

We felt that, versus their global peers, the discount at which these two companies traded was too steep and a narrowing was warranted.

In a volatile and unpredictable market, buying gold provided our portfolios with insurance and achieving the exposure through equities was a cheaper entry point than the metal itself.

In the year and a half that we owned the gold shares, we saw a flat but still high gold price and a re-rating of the global gold sector with all multiples rising.

After Russia invaded Ukraine, the gold price spiked to $2 050/oz, and the multiples of South African gold stocks increased at a greater rate than their global peers. We used this opportunity to begin lowering our position on the resultant reduced margin of safety. We reallocated much of the capital into select global equities, which had become attractively priced.

War, policy and central bank buying boost appeal

Fast forward a year to the present, and we have had an even more extended gold bull run than we initially anticipated, despite a 21% pull back in the second half of 2022 to $1 622/oz.

The impact of Russia’s war and Western stimulus pushed inflation upwards in 2022, which, when combined with several US bank failures in 2023, drove nominal gold prices near to all-time highs at $2 062/oz. Coronation clients have benefited from our exposure to global shares, which have performed well in this period, but would have benefited even more had we remained invested in gold equities.

Read: Coronation’s R105bn ‘Reg 28 fund’ now at the max offshore allocation

In addition to continued high inflation and the US bank failures, we have seen a material increase in central bank buying of gold in the last 12 months (Figure 1).

China has been the primary driver here and helped to drive total central bank purchases up to their highest level in decades.

Central bankers in emerging markets and those less aligned with the US have taken notice of America’s weaponisation of the dollar in response to Russia’s war in Ukraine. Even the Central Bank of the Russian Federation has had its offshore dollar assets frozen in an unprecedented move.

Gold demand

Central bank purchases equaled 24% of global gold demand in 2022 and this has continued at north of 20% in 2023 thus far. This is double the circa 10% run rate from 2010 to 2021 and has been a key driver of the gold price in the short term.

It is plausible that China will continue to buy gold for their reserves, and this could keep prices high versus history.

An offsetting factor is that, while central bank purchases now make up a large portion of annual demand, total gold demand is a tiny fraction of above-ground stocks and annual market balances have had no impact on gold prices over meaningful time periods.

Our ‘normal’ gold price of $1 700 is 36% above the 30-year real average and circa 10% below elevated spot prices. We estimate there is circa 20% downside in both AngloGold and Gold Fields, which compares very unfavourably to cheap equity markets.

Gold Fields and AngloGold share prices

Running to stand still

Our conviction that the multiples must narrow was due to an improved operational outlook at AngloGold and Gold Fields versus their global peers, which had not been reflected in their ratings. Part of this thesis proved right, but the operational improvements at AngloGold have not endured and we have seen a large pickup in mergers and acquisitions at both companies.

The tendency for gold companies to make acquisitions when gold prices and cash flows are good has stuck through this cycle and results in poor shareholder returns over time.

Given the shorter life nature of gold ore bodies in general, we view all capital expenditure, and most acquisitions spend as essential to maintaining group volumes. The larger a company is, the faster it needs to run on the treadmill to stand still.

What we find unique about this more recent rally is that it has been entirely limited to the South African gold shares.

Part of our initial investment case was the narrowing of the multiples gap between AngloGold and Gold Fields and their global peers due to an improved operational outlook. The enterprise value/earnings before interest, taxes, depreciation and amortisation multiple discount peaked at 50% in 2020 and narrowed to 20% in March 2022, a level we felt more accurately reflected the higher cost and shorter life portfolios of AngloGold and Gold Fields.

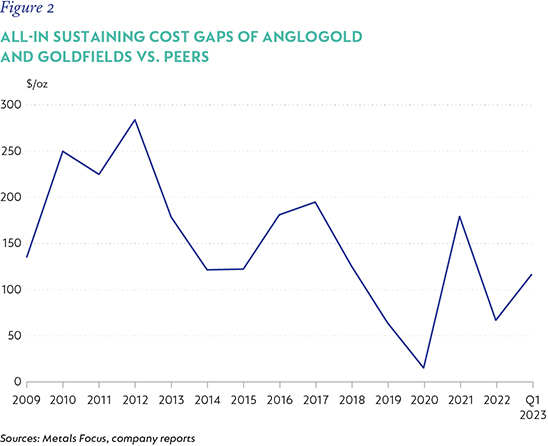

In June 2023, we have since seen that discount narrow to 14.5%, the lowest since 2007. In the last two years, however, we have seen both companies reverse the operational gains they had made versus their peers that justified a re-rating.

Figure 2 shows that the “gap” between their combined all-in sustaining cost and their global peers has increased to the highest in five years, with all the deterioration being driven by AngloGold.

Gold Fields’ operational performance has been better than AngloGold’s, but a massive increase in attempted and successful mergers and acquisitions detracts strongly from this.

Interestingly, the relative multiples of both entities have moved in lockstep, despite Gold Fields’ better operational performance.

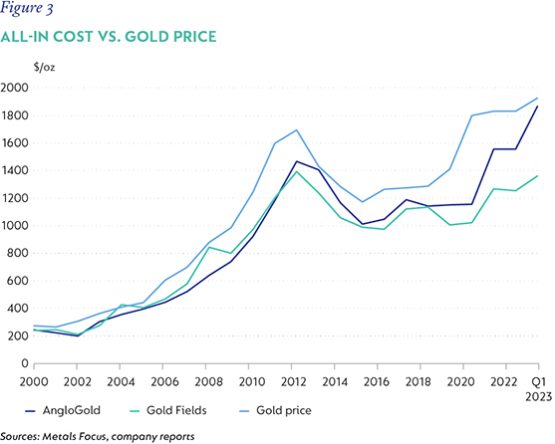

Figure 3 shows the relationship between all-in costs per ounce (operating cost plus all capex) and the gold price over time. AngloGold has seen costs slip meaningfully in recent years such that in the most recent quarter the group was free cash flow negative in a period of near record gold prices.

The group is undergoing an asset review in order to improve costs across all its operations.

AngloGold’s operational performance versus its peers has deteriorated meaningfully in the last two years and, while Gold Fields has had a better operational performance, their attempted $6.7 billion acquisition of Yamana Gold and the more recent $440 million acquisition of the Windfall project highlight how cash flow from record gold prices gets diverted away from shareholders.

In the last five years, AngloGold has only paid out 20% of its earnings in dividends, while Gold Fields has paid out a better, but still meagre 36% in that same period.

The operational history above is intended to highlight that, despite a deterioration in operating performance and capital allocation, the SA gold stocks have re-rated up to the smallest discount to their global peers since 2007.

Given a strong increase in the gold price this year we have seen earnings estimates increase on top of this re-rating; sending the share prices of both companies close to all-time highs. We believe a key driver of the share prices versus their global peers has been large buying from SA index-tracking investors after both shares saw their index weightings increase in March on the back of changes implemented by the JSE.

Read:

AngloGold Ashanti to shift primary listing to New York

PIC boosts Gold Fields stake to 15%

Gold Fields and AngloGold Ashanti tear down the fences in Ghana

Gold Fields share price jumps on termination of Yamana deal

These changes saw their weightings in the Capped Swix Index increase from 3.58% to 5.33% towards the end of March. A sharply rising gold price and a much bigger index weighting drew in a lot of buyers to AngloGold and Gold Fields and have now pushed the shares well above our assessment of their fair values.

It is worth noting that when AngloGold shifts its primary listing to the US, it will see its index weighting in the FTSE/JSE Capped SWIX reduce by nearly two thirds.

AngloGold and Gold Fields are shorter life and higher cost assets than their peers and we believe the current multiples they trade on are too generous. The gold price has seen the benefit of several tailwinds in the last few years, which could abate going forward, with the key unknown being central bank buying of the metal.

After the recent rally, we find the JSE-listed gold shares even more overvalued than they were before.

With near record upside on offer across our SA equity portfolios and attractive opportunities in global markets, we feel that the current risk/reward on offer in SA gold equities is not in our favour and hold no position in either AngloGold or Gold Fields.

Nicholas Hops is head of South African Equity Research and a portfolio manager at Coronation.