One theme stood out when Absa’s crew of economists hosted a webinar in regards to the prospects for the South African economy for the following 12 months or so: each one of many presenters talked about that there are such a lot of uncertainties that forecasting the nation’s prospects over the following few months might be extraordinarily troublesome.

The economists listed the standard challenges going through SA and the monetary wellbeing of its residents, and even added the potential of a number of sudden occasions that may render their forecast moot.

“There [is] no respite from multiple challenges facing the SA economy,” mentioned Absa economist Peter Worthington.

“An already-weak development outlook has been additional dampened by numerous headwinds and ongoing structural constraints.

“While GDP figures were higher than expected in the first quarter of 2022, intensified electricity shortages and a less supportive global economy led us to cut our growth estimate for 2023,” he added, noting that he expects electrical energy disruptions to proceed for the remainder of the 12 months and in 2023.

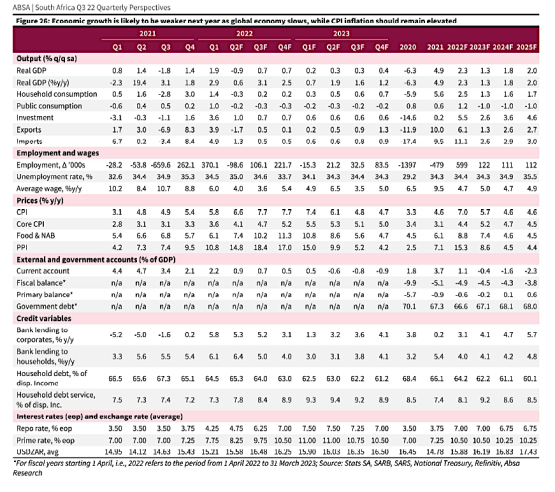

In their South Africa Q3 22 Quarterly Perspectives report, the economists observe that SA’s first quarter development of 1.9% (quarter on quarter) was nearly double what they anticipated.

“However, after a flood-ravaged April, activity data for May were quite subdued, with both manufacturing and mining output data so far suggesting that these sectors may subtract from growth in the second quarter,” states the report.

Of significance is that earnings for commodity exports decreased from earlier excessive ranges resulting from decrease demand, decrease costs and transport constraints, in addition to constraints at ports.

ALSO READ: SA’s ‘two great failures’ contributed to the downward spiralling of the economy

Eskom

In line with normal consensus, Absa additionally flags unreliable electrical energy provide as the largest menace going through the SA economy.

“The electricity plan that President [Cyril] Ramaphosa announced earlier this week will begin alleviating load shedding only from the middle of 2024,” mentioned Worthington.

He added that Eskom’s critical debt downside just isn’t going away; the utility remains to be in bother.

To repair Eskom’s steadiness sheet, he expects that a number of the utility’s debt may be moved “onto Treasury’s balance sheet”. This has a optimistic in that it’s going to price Treasury much less general, as direct transfers to Eskom may be decrease in future.

Absa’s mounted revenue strategist Mike Keenan mentioned load shedding has had a big effect on the change fee due to its influence on sentiment and investor confidence.

While he makes a compelling case that the rand is definitely weaker than it needs to be (in contrast with the currencies of different creating economies reliant on commodity exports), he mentioned destructive sentiment relating to the consequences of load shedding is pushing the rand even decrease.

“The rand lost five cents against the dollar every day of stage 6 load shedding. It does not sound like much, but it accumulates over time,” mentioned Keenan, warning of the inflationary results of a weak foreign money.

Inflation

The economists spent numerous time speaking about inflation – most likely the primary subject across the monetary world.

“Inflation has recently surprised to the upside,” mentioned Absa economist Miyelani Maluleke, including that worth pressures are broadening past gasoline and meals.

“We now see CPI [Consumer Price Index] inflation peaking at 7.9% in October this 12 months and remaining above the higher 6% band of the goal vary till mid-2023 and the 4.5% midpoint till 2024.

“Our relatively bullish oil price assumption leaves some downside risk to our CPI forecast, but like the Sarb [South African Reserve Bank], we see the balance of inflation risks lying to the upside,” he mentioned.

In addition to the standard dialogue about how inflation has elevated around the globe and the following improve in rates of interest to interrupt inflationary pressures, the crew warned in regards to the danger of SA shifting too slowly to scale back inflation.

“If the US Federal Reserve is profitable in decreasing inflation within the US whereas SA struggles, the inflation differential will trigger the rand to say no steadily.

“In this case we see the rand remaining above R16 to the dollar,” mentioned Keenan, regardless of his perception that the rand is oversold by way of buying energy parity.

He additionally warned that the rand may come beneath stress if demand for commodities declines, as it would have a detrimental impact on the steadiness of funds.

ALSO READ: SA economy effectively on its option to ‘technical recession’

According to the report: “The rand appears fundamentally undervalued, but recovery is likely to be slow. We believe weaker terms of trade and ongoing structural constraints on exports will erode the current account surplus, returning it to a deficit in 2023, earlier than Absa’s prior forecast.”

As a outcome, Absa forecasts steeper rate of interest hikes.

“We now see more aggressive monetary tightening. The Sarb’s recent decision to hike the repo rate by 75 basis points reveals a sharply more hawkish stance. In contrast to our previous forecast, we now see the repo rate rising beyond the neutral level for some time, as the Sarb tries to reverse rising inflation expectations,” mentioned Maluleke.

“The Sarb could take the repo rate up to 7.5% fairly swiftly over the next few meetings, before easing gradually from mid-2023, when inflation should begin to fall again,” he added.

Many futures

Worthington threw a number of wild playing cards out too. “Nobody can predict the precise final result of the upcoming ANC elective convention. Just a few months in the past, it seemed like Ramaphosa had sturdy backing, however no one is aware of the dynamics enjoying out on the ground.

“Only final weekend, the important thing province of KwaZulu-Natal elected a management faction that’s against Ramaphosa.

“The upcoming general election creates more uncertainty. An uncertain political situation is not positive for effective and stable government,” he mentioned.

He added the potential of one other bout of social unrest to the record of unknowns to cope with.

The Absa report concludes that issues can simply turn into worse than at present anticipated.

“As we now have argued earlier than, making a weak economy operate higher usually requires numerous troublesome coverage modifications and a giant dose of luck to all cohere collectively.

For SA particularly, we see some upside danger to our baseline forecast within the chance that the federal government swiftly implements its putative anti-corruption and structural reform agendas.

“However, the obstacles to this are vital – particularly a weak paperwork and an ideologically and factionally conflicted political management.

“We believe that downside risks to our baseline forecast dominate the upside. We see a big downside risk to our baseline forecast if another violent social unrest erupts, given the backdrop of surging inflation, rising unemployment and the increasingly desperate factional battle for control within the ANC,” warns the report.

All forecasts at a look

This article first appeared on Moneyweb and was republished with permission. Read the unique article here.