European stocks and US equity futures kept to small ranges as investors parsed the latest corporate earnings for insights on the state of the global economy and the impact of supply chain pressures.

Rallying miners supported Europe’s Stoxx 600 index as optimism over demand from China pushed iron ore prices higher. Energy stocks rose as crude oil held gains following a fresh round of US and UK strikes against Iran-backed Houthi rebels launching attacks on Red Sea shipping. US equity futures were flat after stocks on Wall Street advanced modestly on Monday to close at fresh record highs. Asian shares mostly rose as mainland Chinese stocks rejoined a broader rally on news of a fresh market rescue package.

ADVERTISEMENT

CONTINUE READING BELOW

Earnings are in focus for investors as the reporting season intensifies this week, with Netflix, Tesla Inc and Intel Corp among those due to provide updates. In Europe, Ericsson AB fell Tuesday after the Swedish company warned that its market outside of China will continue to decline in 2024.

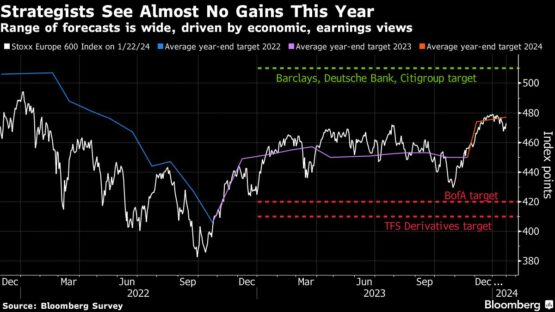

On the broader outlook for European stocks, equity strategists surveyed by Bloomberg predict that dull economic and earnings growth will limit gains this year and they recommend that investors wait for pull-backs before stepping into the market again. The Stoxx Europe 600 Index will end 2024 at 477 points, according to the average forecast of 18 respondents — indicating pretty much no upside from last Friday’s close.

The yen extended its gains as investors looked for signs of when the Bank of Japan will exit from its ultra-loose monetary policy. BOJ Governor Kazuo Ueda said certainty in the outlook is rising gradually. The swaps market was pricing a 45% probability of a rate hike by the BOJ’s April meeting, with the likelihood rising to 100% by the July gathering. The BOJ maintained its -0.1% short-term rate and kept its yield curve control parameters intact at the end of a two-day meeting.

A gauge of dollar strength slipped, while 10-year Treasury yields were steady following a slide on Monday.

In Asian share trading, a gauge of Chinese firms listed in Hong Kong jumped 3.2%, with the CSI 300 onshore benchmark erasing earlier losses to add 0.4%. Authorities are seeking to mobilize about 2 trillion yuan ($278 billion), mainly from the offshore accounts of Chinese state-owned enterprises, as part of a stabilization fund to buy shares onshore, according to people familiar with the matter.

“As participants in this market, we really hope that a stabilisation fund can come in to support the market, given how bad things have been,” said Daisy Li, fund manager at EFG Asset Management HK Ltd. “There might be some short covering behind the gains in market today.”

ADVERTISEMENT

CONTINUE READING BELOW

Elsewhere in Asia, India’s stock market has overtaken Hong Kong’s as the world’s fourth-largest share market for the first time as the South Asian nation’s growth prospects and policy reforms make it an investor darling.

Key events this week:

- Eurozone consumer confidence, Tuesday

- New Hampshire holds first-in-the-nation presidential primary, Tuesday

- European Central Bank issues bank lending survey, Tuesday

- Canada rate decision, Wednesday

- Eurozone S&P Global Services & Manufacturing PMI, Wednesday

- US S&P Global Services & Manufacturing PMI, Wednesday

- Eurozone ECB rate decision, Thursday

- Germany IFO business climate, Thursday

- US GDP, initial jobless claims, durable goods, wholesale inventories, new home sales, Thursday

- Japan Tokyo CPI, Friday

- US personal income & spending, Friday

- Bank of Japan issues minutes of policy meeting, Friday

Some of the main moves in markets:

Stocks

- The Stoxx Europe 600 was little changed as of 8:22 a.m. London time

- S&P 500 futures were little changed

- Nasdaq 100 futures fell 0.1%

- Futures on the Dow Jones Industrial Average were little changed

- The MSCI Asia Pacific Index rose 0.5%

- The MSCI Emerging Markets Index rose 0.5%

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro rose 0.2% to $1.0903

- The Japanese yen rose 0.5% to 147.43 per dollar

- The offshore yuan rose 0.3% to 7.1720 per dollar

- The British pound rose 0.2% to $1.2734

Cryptocurrencies

- Bitcoin fell 0.4% to $39,649.69

- Ether fell 0.4% to $2,314.91

Bonds

- The yield on 10-year Treasuries advanced one basis point to 4.12%

- Germany’s 10-year yield advanced two basis points to 2.31%

- Britain’s 10-year yield advanced one basis point to 3.92%

Commodities

- Brent crude rose 0.2% to $80.21 a barrel

- Spot gold rose 0.4% to $2 029.35 an ounce

This story was produced with the assistance of Bloomberg Automation.

© 2024 Bloomberg