Asian shares and US and European equity futures fell Tuesday as investors positioned for interest-rate hikes this week from the Federal Reserve and the European Central Bank.

Equities benchmarks for China, Japan, India, South Korea and Australia all dropped, with small early gains in some markets evaporating. The moves extended on a torrid session on Wall Street that dragged the Nasdaq 100 to its worst day since December 22 as Apple and Microsoft Corp. weighed on the market.

Samsung Electronics fell about 3.5% in Seoul, weighing on South Korea’s Kospi gauge, after profit slumped on poor demand for semiconductors and weakness in smartphones and memory chips.

In Hong Kong, Alibaba’s decline this week reached around 9%, reducing its market value by $28 billion amid concern that China’s consumer recovery may fail to meet lofty expectations.

The drop in Alibaba, and Chinese shares in general, still leaves them well up this year. An index of global equities also remained on course for a gain of about 6% in January.

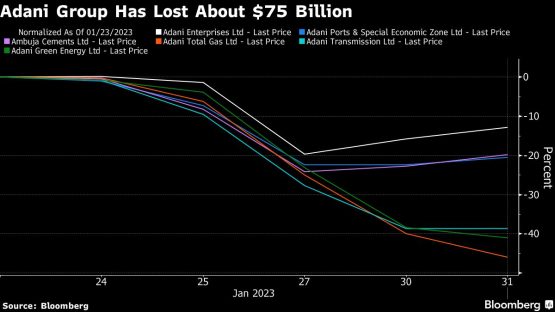

The selloff in Adani Group shares continued. While the flagship Adani Enterprises was up about 2% in early trading as the company’s $2.5 billion follow-on share sale enters its final day, other parts Gautam Adani’s business empire were sharply lower.

Ten of the conglomerate’s companies have seen about $75 billion in market value erased after US short-seller Hindenburg Research leveled fraud accusations last week.

A measure of dollar strength was largely unchanged after the greenback climbed versus all its Group-of-10 counterparts on Monday. The yield on 10-year Treasuries was also little changed around 3.54%.

Hanging over everything is Wednesday’s Fed decision, with the US central bank widely expected to raise rates by a quarter percentage point. Investors will be watching for the tone officials set for future meetings after Fed Chair Jerome Powell’s consistent efforts to push back against traders anticipating rate cuts later this year.

The rally in stocks this month suggests the market has so far brushed off Powell’s warning of “higher-for-longer” interest rates.

“Even after they’ve stopped on the rate hikes, there is still the quantitative tightening that still poses a threat for a lot of risk assets,” Mary Nicola, a global multi-asset portfolio manager for PineBridge Investments, said in an interview with Bloomberg Radio.

Elsewhere in markets, oil fell further after touching a three-week low on Monday. Traders are waiting for more clues on Chinese demand, the Fed decision and the latest guidance from OPEC+.

Also on the agenda for the week are policy meetings in Europe and the UK on Thursday, and the US jobs report on Friday. A less tight labor market is a key goal for the Fed.

Key events this week:

- Eurozone GDP, Tuesday

- US Conference Board consumer confidence, Tuesday

- Earnings Tuesday include: UBS, Unicredit, Snap and Advanced Micro Devices

- Eurozone Manufacturing PMI, CPI, unemployment, Wednesday

- US construction spending, ISM Manufacturing, light vehicle sales, Wednesday

- FOMC rate decision, Fed Chair Jerome Powell press conference, Wednesday

- Earnings Wednesday include: Meta Platforms and Peloton Interactive

- Eurozone ECB rate decision, President Christine Lagarde press conference, Thursday

- UK BOE rate decision, Thursday

- US factory orders, initial jobless claims, US durable goods, Thursday

- Earnings Thursday include: Alphabet, Apple, Amazon, Qualcomm and Deutsche Bank and Santander

- Eurozone S&P Global Eurozone Services PMI, PPI, Friday

- US unemployment, nonfarm payrolls, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 2:28 p.m. Tokyo time. The S&P 500 fell 1.3%

- Nasdaq 100 futures fell 0.2%. The Nasdaq 100 fell 2.1%

- Japan’s Topix fell 0.2%

- Hong Kong’s Hang Seng fell 1.3%

- The Shanghai Composite fell 0.4%

- Euro Stoxx 50 futures fell 0.4%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0845

- The Japanese yen was little changed at 130.28 per dollar

- The offshore yuan was little changed at 6.7582 per dollar

- The Australian dollar fell 0.3% to $0.7040

Cryptocurrencies

- Bitcoin rose 0.5% to $22,857.73

- Ether rose 1% to $1,571.64

Bonds

- The yield on 10-year Treasuries was little changed at 3.54%

- Japan’s 10-year yield rose one basis point to 0.485%

- Australia’s 10-year yield advanced one basis point to 3.55%

Commodities

- West Texas Intermediate crude fell 0.4% to $77.56 a barrel

- Spot gold was little changed

© 2023 Bloomberg