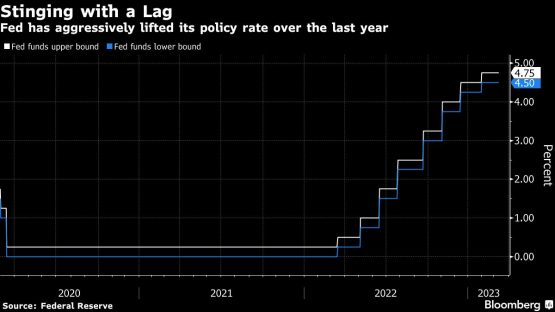

One year after the Federal Reserve started frantically raising interest rates, the collapse of Silicon Valley Bank answered what had become perhaps the hottest question on Wall Street: When is something going to break?

Its seizure by regulators, which marked the biggest bank failure since the 2008 crisis, is triggering a rapid recalculation on trading desks of how willing the Fed will be to keep tightening to tame inflation. Traders are now betting that the Fed will hike just once more or not at all this year — a staggering about-face from speculation last week about how large the next increase would be. What’s more, they’re reviving wagers that officials will be forced to start cutting rates before the year is over.

The irony is that many on Wall Street had just started to consider the possibility that their instincts had been wrong and their initial concerns unfounded. The economy was holding up remarkably well — companies were still hiring and loan defaults were low — and so perhaps the acute pain from rate hikes, this new thinking went, would be contained to the bursting of bubbles in things like cryptocurrencies and meme stocks. In the last few weeks, they had pushed their expectations for the peak rate higher, egged on by tough inflation talk by Fed Chair Jerome Powell.

They just needed, it turns out, to give the effects of rate hikes a bit more time to show up. And they’re now left to decipher the path the Fed, caught between stubbornly high inflation and signs of strain in the banking sector, will carve out.

“Now we are starting to feel finally those long and variable lags with which monetary policy works,” Blerina Uruci, chief US economist at T. Rowe Price Associates, told Bloomberg Television Friday. “The first sign of that is, I think, what we are seeing with the Silicon Valley Bank here. Lots of businesses and banks – we are going to find this year – aren’t able to operate at these higher interest rates.”

While SVB’s woes now seem unlikely to pose a systemic financial risk, its stunning collapse is a reminder that the banking sector remains vulnerable to sharply rising funding costs after years of operating in a low rate environment. Its disintegration forced the Fed to set up a new emergency facility to let banks pledge a range of high-quality assets for cash over a term of one year. And regulators also pledged to fully protect even uninsured depositors at the lender.

Given the delay in how tighter monetary policy translates to the real economy, traders are now on the lookout for further signs that may indicate the Fed is finally engineering the slowdown it wants — albeit in a messier, more abrupt, manner than it probably would have liked.

Two-year yields at one point fell nearly 60 basis points Monday to 3.99%, the lowest since October, and remain on pace for the steepest three-day decline since Black Monday of October 1987. Demand for Treasuries of all maturities surged as investors continued to flee bank shares.

“Bank stress may be seen as a sign that monetary policy is working to tighten conditions, albeit with a lag,” said Mark Dowding, chief investment officer at RBC BlueBay Asset Management.

History shows that the road for rate hikes to have a meaningful impact on the economy can be bumpy and lengthy.

For example, Fed hikes of more than 400 basis points were expected to hit the brakes on the labor market, but that hasn’t yet happened, with data Friday coming in mixed at best.

“A year ago if you had said the Fed would tighten 450 basis points in 12 months, you would think the economy would be rolling over now,” said John Madziyire, portfolio manager at Vanguard Group Inc. But “it has not had much impact.”

As well as so many mortgage rates locked in at low levels, there are also issues on the labor market side of things, Madziyire said. Labour market participation is super tight given so many people decided to retire early during the pandemic and immigration was restricted for a long time.

A key consideration here is whether the US economy is less sensitive to interest rates in the wake of borrowing costs falling to generational lows during the pandemic. For example, more than 40% of all US mortgages were originated in 2020 or 2021, according to data from Black Knight.

But with SVB’s collapse suggesting monetary policy is starting to take effect, the question now is how the Fed will balance its mandate to curb inflation with fractures in the economy.

Goldman Sachs Group Inc. has scrapped its call for a rate hike at next week’s Fed meeting. Traders now see the peak US benchmark at about 4.7% mid-year, down from 5.7% just days ago. And while there’s certainly potential for a snapback in rates if consumer price data due Tuesday shows that inflation remains rampant, investors are starting to consider the extent of wealth destruction caused by financial stress and how that could itself moderate inflation.

“This time is not different — Fed tightening cycles always end with the breaking of something,” said Jack McIntyre, portfolio manager at Brandywine. “Bad things happen when you take away liquidity too soon. It was going to be either the economy or inflation, and instead we have the financial system breaking.”

© 2023 Bloomberg