Newcrest Mining rejected an initial $17 billion takeover bid by US rival Newmont Corp., with the Australian miner’s interim CEO saying the company was “worth a lot more.”

It did offer some hope to its suitor, however, by indicating it’s prepared to provide access to its books on a non-exclusive basis.

The all-shares deal would have been the largest globally this year and created the world’s biggest gold miner. Newcrest is an attractive target because of the comparatively long life of its gold assets — more than 20 years — as well as its deposits of copper.

“The company is not up for sale and this was unsolicited,” Sherry Duhe, the interim chief executive officer, said in an interview on Bloomberg Television. “We have offered Newmont limited conversations to share a bit more about where we see value in the portfolio, and so obviously that’s with them now to see if they’d like to decide to engage.”

Newcrest shares fell as much as 2.5% in Sydney on Thursday. They are still up around 6% since the close on February 3, the last trading day before the Newmont offer, but are below the current value of the offer, suggesting that shareholders do not believe the deal will get done at the current price.

The Australian miner is going through a period of management transition after its veteran CEO, Sandeep Biswas, left at the end of last year. For Newmont, eager to put some distance between itself and rival Barrick Gold Corp., the deal is an opportunity to acquire future ounces but also scale, which matters as gold miners seek to attract more non-specialist investors.

Newcrest has “left a door open to a higher premium deal,” Alex Barkley, an analyst at RBC Capital Markets, said in a note. The onus is now on Newmont to find a premium for Newcrest that also satisfies its own shareholders, although the deal not occurring is a possibility, he said.

Newmont didn’t immediately respond to a request for comment.

Gold mining executives and analysts have said an upswing in gold mergers is overdue, driven by dwindling production at existing mines, a lack of new discoveries and a sustained period of historically high gold prices.

However, Barrick President and CEO Mark Bristow said in a Bloomberg TV interview that he didn’t see any value mergers or acquisitions in the market right now.

Newcrest’s copper assets account for around a quarter of revenue. Demand for the metal that’s key for renewable energy infrastructure, electric vehicles and electricity networks is expected to surge as the world moves away from fossil fuels.

“We had previously felt that the offer was too low initially,” said Simon Mawhinney, chief investment officer at Allan Gray, one of Newcrest’s biggest shareholders. “More important is their willingness to engage and offer Newmont some limited due diligence.”

Some analysts had earlier questioned Newmont’s valuation, with Citigroup Inc.’s Kate McCutcheon saying in a research note on February 12 that a “bump to the offer price will be required.”

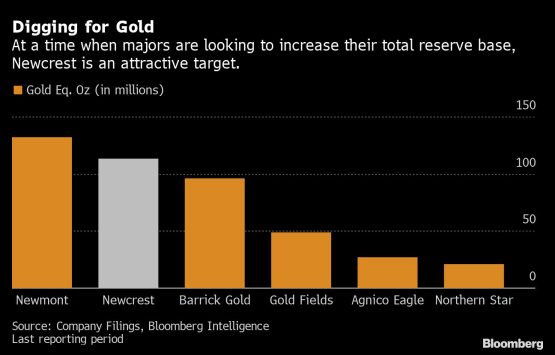

Newcrest’s decision to reject the offer was “justified,” Bloomberg Intelligence analyst Mohsen Crofts said in a note. “Newcrest has the largest reserve base behind Newmont, priced at a lower enterprise value to reserves compared with peers.”

Newcrest on Thursday reported a slight drop in profit in the six months through December, compared with a year earlier, even as gold production increased 25% and copper output rose 32%.

The rebuff of Newmont allows other parties to consider buying all or some of Newcrest’s assets, Daniel Morgan, an analyst at Barrenjoey Markets, said in a note. Options worthy of consideration include asset sales followed by a buyback and/or a de-merger of Lihir, a gold mine Newcrest operates in Papua New Guinea, he said.

© 2023 Bloomberg