Chinese policymakers have stepped up their efforts in recent weeks to support the economy and sliding markets, underscoring concern about a recovery hampered by a property crisis, deflation and weak consumer confidence.

The measures have included unleashing more long-term cash for banks, tightening rules on the lending of shares for short selling and broadening developer access to loans. Still, investors may need to see more to restore their trust in China’s markets.

ADVERTISEMENT

CONTINUE READING BELOW

The benchmark CSI 300 Index is down around 4% so far in 2024, trading near the lowest in five years. The yuan has joined a retreat by most other Asian currencies this year, while the yield on the benchmark government bond fell to its lowest in nearly 22 years on Tuesday amid bets on more easing.

Extra help for the economy may be necessary if the government wants to announce an ambitious target for expansion this year when the national legislature convenes in March. Many Chinese provinces are targeting gross domestic product growth of 5% or higher in 2024, and economists are already expecting a fairly ambitious goal.

Here’s a list of measures that have either been either announced or reported on to start the year as China seeks to aid the economy and calm investors.

28 January: Securities lending restriction

Securities regulators said they will halt the lending of certain shares for short selling, the latest attempt to put a floor under the stock market rout. Strategic investors, which typically refers to holders with restricted shares, won’t be allowed to lend out the stock during agreed lock-up periods.

27 January: Real estate easing

Guangzhou, one of China’s biggest cities, further loosened home-buying curbs in a bid to stem falling prices. Beijing, Shanghai and Shenzhen have lowered down-payment requirements since November.

26 January 26: Aid for developers

The Ministry of Housing and Urban-Rural Development said it will provide a list of housing projects eligible for funding support by the end of the month, the latest attempt to boost lending for real estate to slow the sector’s slump.

The same day, the National Financial Regulatory Administration urged banks to support requests by qualified developers including extending existing loans and adjusting repayment arrangements.

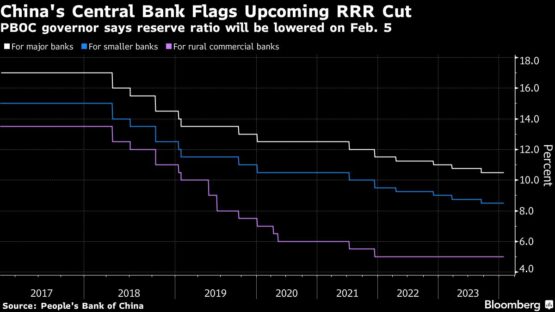

24 January: RRR cut, property loans, more

People’s Bank of China Governor Pan Gongsheng said the central bank will lower the reserve requirement ratio — the amount of cash lenders must keep in reserve — by 0.5 percentage points on Feb. 5 to release 1 trillion yuan ($139 billion) in long-term liquidity to the market. The announcement, coming after official data showed the nation’s economy was still grappling with major challenges, marked the biggest RRR cut since 2021.

Hours later, regulators unveiled more measures, including broadening the use of commercial property loans for developers to help them repay other debt.

ADVERTISEMENT

CONTINUE READING BELOW

The same day, authorities in China and Hong Kong announced steps to deepen financial ties, including facilitating real estate purchases and expanding a program that allows for personal investments in the Greater Bay Area, a region of 70 million people that includes Hong Kong and megacities in the southern mainland such as Shenzhen and Guangzhou.

23 January: Stock rescue package

Policymakers are considering using about 2 trillion yuan, mainly from the offshore accounts of Chinese state-owned enterprises, as part of a stabilization fund to buy shares onshore through the Hong Kong exchange link, Bloomberg reported. They have also earmarked at least 300 billion yuan of local funds to invest in onshore shares through China Securities Finance Corp. or Central Huijin Investment. A day earlier, Premier Li Qiang asked authorities to take more “forceful” measures to stabilize the stock market and investor confidence. His request came after the CSI 300 Index touched a five-year low.

19 January: Signs of state buying

The aggregate turnover in some of the country’s top exchange-traded funds — commonly watched for signs of state-led buying — reached the third-largest weekly total ever. It was the most since July 2015, when the so-called “national team” tried to offset selling momentum amid an epic bubble bursting.

16 January: Special bonds

China is considering 1 trillion yuan of new debt issuance under a so-called special sovereign bond plan, Bloomberg News reported. The proposal discussed by senior policymakers would involve the sale of ultra-long sovereign bonds to fund projects related to food, energy, supply chains and urbanization.

5 January: Rental housing

The PBOC and the NFRA published guidelines on financial support for the development of the market for rental housing. That included a policy to encourage banks to provide loans for developers, industrial zones, certain rural organizations and companies to build new homes for long-term renting or renovating existing facilities for that purpose.

© 2024 Bloomberg