Profits and losses aren’t normally considered a consideration for central banks, however quickly mounting purple ink on the Federal Reserve and plenty of friends dangers changing into extra than simply an accounting oddity.

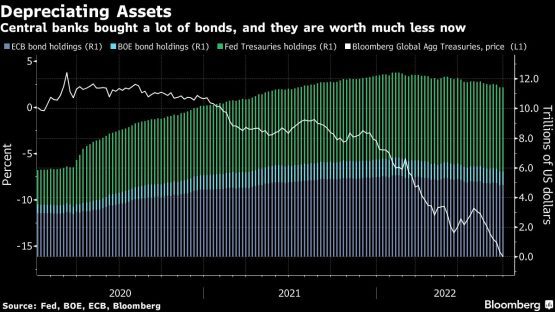

The bond market is enduring its worst selloff in a era, triggered by excessive inflation and the aggressive interest-rate hikes that central banks are implementing. Falling bond costs, in flip, imply paper losses on the huge holdings that the Fed and others collected throughout their rescue efforts lately.

Rate hikes additionally contain central banks paying out extra curiosity on the reserves that industrial banks park with them. That’s tipped the Fed into working losses, making a gap that might finally require the Treasury Department to fill by way of debt gross sales. The UK Treasury is already getting ready to make up a loss on the Bank of England.

Britain’s transfer highlights a dramatic shift in nations together with the US, the place central banks are now not vital contributors to authorities revenues. The US Treasury will see a “stunning swing,” going from receiving about $100 billion final yr from the Fed to a possible annual loss price of $80 billion by year-end, based on Amherst Pierpont Securities LLC.

The accounting losses threaten to gasoline criticism of the asset buy applications undertaken to rescue markets and economies, most just lately when Covid-19 shuttered giant swathes of the worldwide economic system in 2020. Coinciding with the present outbreak in inflation, that might spur calls to rein in financial coverage makers’ independence, or restrict what steps they will take within the subsequent disaster.

“The problem with central bank losses are not the losses per se — they can always be recapitalised — but the political backlash central banks are likely to increasingly face,” stated Jerome Haegeli, chief economist at Swiss Re, who beforehand labored at Switzerland’s central financial institution.

The following figures illustrate the scope of working losses or mark-to-market balance-sheet losses now materialising:

- Fed remittances owed to the US Treasury reached a unfavourable $5.3 billion as of October 19 — a pointy distinction with the constructive figures seen as just lately as the top of August. A unfavourable quantity quantities to an IOU that could be repaid by way of any future revenue.

- The Reserve Bank of Australia posted an accounting lack of A$36.7 billion ($23 billion) for the 12 months by June, leaving it with a A$12.4 billion negative-equity place.

- Dutch central financial institution Governor Klaas Knot, warned final month he expects cumulative losses of about 9 billion euro ($8.8 billion) for the approaching years.

- The Swiss National Bank reported a lack of 95.2 billion francs ($95 billion) for the primary six months of the yr as the worth of its foreign-exchange holdings slumped — the worst first-half efficiency because it was established in 1907.

While for a creating nation, losses on the central financial institution can undermine confidence and contribute to a common exodus of capital, that type of credibility problem isn’t doubtless for a wealthy nation.

As Seth Carpenter, chief world economist for Morgan Stanley and a former US Treasury official put it: “The losses don’t have a material effect on their ability to conduct monetary policy in the near term.”

RBA Deputy Governor Michele Bullock stated in response to a query final month concerning the Australian central financial institution’s negative-equity place that “we don’t believe that we are impacted at all in our capacity to operate.” After all, “we can create money. That’s what we did when we bought the bonds,” she famous.

But there can nonetheless be penalties. Central banks had already turn into politically charged establishments after, by their very own admission, they did not anticipate and act rapidly towards budding inflation over the previous yr or extra. Incurring losses provides one other magnet for criticism.

ECB implications

For the European Central Bank, the potential for mounting losses comes after years of purchases of presidency bonds performed regardless of the reservations of conservative officers arguing they blurred the strains between financial and monetary coverage.

With inflation operating at 5 occasions the ECB’s goal, strain is mounting to eliminate the bond holdings — a course of known as quantitative tightening that the ECB is at the moment getting ready for even because the financial outlook darkens.

“Although there are no clear economic constraints to the central bank running losses, there is the possibility that these become more of a political constraint on the ECB,” Goldman Sachs Group Inc. economists George Cole and Simon Freycenet stated. Particularly in northern Europe, it “may fuel the discussion of quantitative tightening.”

President Christine Lagarde hasn’t given any indication that the ECB’s resolution on QT shall be pushed by the prospect of incurring losses. She instructed lawmakers in Brussels final month that producing profits isn’t a part of central banks’ activity, insisting that preventing inflation stays policymakers’ “only purpose.”

As for the Fed, Republicans have prior to now voiced opposition to its follow of paying curiosity on surplus financial institution reserves. Congress granted that authority again in 2008 to assist the Fed management rates of interest. With the Fed now incurring losses, and the Republicans probably taking management of a minimum of one chamber of Congress within the November midterm elections, the talk might resurface.

The Fed’s turnaround could possibly be significantly notable. After paying as a lot as $100 billion to the Treasury in 2021, it might face losses of greater than $80 billion on an annual foundation if policymakers elevate charges by 75 foundation factors in November and 50 foundation factors in December — as markets anticipate — estimates Stephen Stanley, chief economist for Amherst Pierpont.

Without the revenue from the Fed, the Treasury then must promote extra debt to the general public to fund authorities spending.

“This may be too arcane to hit the public’s radar, but a populist could spin the story in a way that would not reflect well on the Fed,” Stanley wrote in a observe to purchasers this month.

© 2022 Bloomberg