UBS Group AG’s emergency buyout of Credit Suisse Group AG threatens to drastically shrink the financing options for small and mid-sized companies, after the demise of a 166-year-old champion of Swiss entrepreneurship.

While smaller cantonal lenders and cooperative banks offer a counterbalance to UBS in retail banking and the Swiss mortgage market, Credit Suisse has long been the market leader in serving companies’ more complex needs.

That makes the profitable Swiss unit a prized possession for UBS, with chairman Colm Kelleher saying during the announcement of the $3 billion deal on Sunday that he was determined to hang on to the unit. And despite the focus by local politicians and investors on not handing one bank overwhelming power in the local market, there’s little push yet from regulators to keep the Swiss business independent.

“It’s not end of corporate finance in Switzerland but from perspective of competition, the idea of integrating Credit Suisse’s Swiss unit is not a very good one,” said Tobias Straumann, a professor of economic history at the University of Zurich. “It’s really the weak spot of this deal. Credit Suisse was the best in this field.”

Industrial expansion

Credit Suisse has been the leader in Swiss domestic investment banking activity in terms of deal value for at least a decade. That points to the role of the bank’s historical predecessor, Schweizerische Kreditanstalt, founded by railway pioneer Alfred Escher in 1856 to finance the nation’s industrial expansion.

The local unit is in many ways a miniature version of the group itself, with retail, private banking, corporate and investment bank functions.

Last year, the Swiss unit’s investment bankers led in M&A as well as debt and equity-capital markets, helping raise funds for the likes of food multinational Nestle SA and pharma-giant Roche Holdings AG.

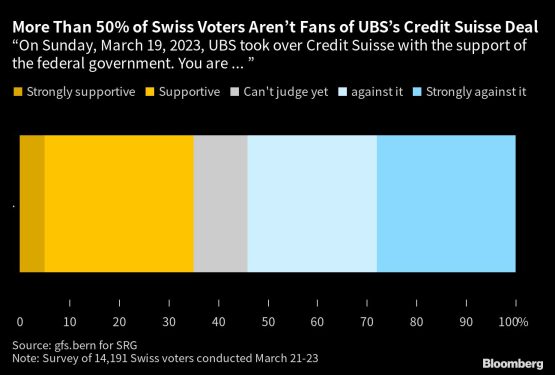

In a national poll published Friday, a majority of respondents said they didn’t support the fusion of the two banks. Fully three quarters of respondents said they believed that the Swiss financial sector as a whole would be weakened by the deal.

In the wake of the deal, specialty chemicals maker Clariant AG warned the takeover will reduce competition of the nation’s corporate banking services, leading to stronger pricing power for UBS in segments not well served by Switzerland’s smaller banks.

“It is certainly not good that there is now only one big bank,” Clariant said this week.

Analysts have valued Credit Suisse’s Swiss Universal Bank at around 10 billion Swiss francs ($10.9 billion), about triple what UBS paid for the whole bank.

Clariant said that it had worked with Credit Suisse and UBS in competition, and may partner more closely with other Swiss banks in the future. Part of the problem is that those smaller lenders lack expertise in corporate finance, according to economic historian Straumann.

Foreign competition

Swiss trainmaker Stadler Rail AG echoed Clariant’s warning Thursday, saying the bank takeover will lead to less competition. Stadler will have to shift more of its Swiss business to large foreign banks in the long term, which will cost local jobs, the company said.

UBS’s acquisition of Credit Suisse will provide an opportunity for foreign banks to expand into Swiss corporate finance, said Straumann. At the same time, the pressure to spin off Credit Suisse’s local business will increase, especially with elections later this year. That may eventually push UBS to cash in on an investment that’s widely perceived as harmful for its home market.

“In terms of calming international markets, it was the best solution,” said Straumann. “From the perspective of competition within Switzerland, it was second-best.”

© 2023 Bloomberg