Aveng CEO Sean Flanagan declared on Tuesday that the group’s balance sheet “is in the best shape it has been in over eight years” and added that “a loss-making, overgeared business that was underinvested in equipment, systems and people has been turned around”.

Flanagan made the comments following the release of the group’s latest interim results.

Read: Tirisano Construction Fund to institute legal action against Aveng

The JSE-listed construction and engineering group reported further progress on its major restructuring and revised strategy. It has for the fifth consecutive reporting period delivered profitable earnings in the six months to end-December 2022.

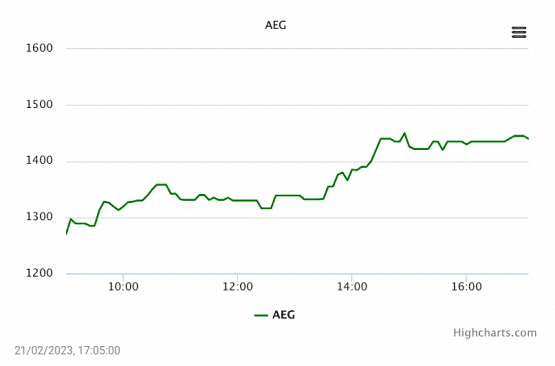

The market reacted positively to this news, with the share price rising 13.39% to close at R14.40 per share on Tuesday.

Source: Moneyweb

Debt slashed

“We have reduced the South Africa legacy debt from R3.3 billion in 2018 to R353 million at December 31 2022.

“The remainder of this debt will be settled on receipt of the proceeds from the Trident Steel sale,” said Flanagan.

It is envisaged that the disposal of Trident Steel, for R691 million plus the R273 million cash in the business, will be implemented “sometime later this financial year”.

“The deleveraged balance sheet creates the platform to invest for profitable growth.”

Read: Aveng turnaround: R700m sale of Trident Steel a ‘major milestone’

The core remaining businesses in Aveng are McConnell Dowell, the group’s Australia-based subsidiary, and Moolmans, the group’s southern African open-pit mining business.

McConnell Dowell contributed about 75% of Aveng’s total revenue and R175 million of the group’s total R181 million operating earnings in the six months to end-December.

Aveng increased its work in hand by 73% to R53.3 billion at end-January 2023 from R30.8 billion in June 2022.

Australian activity

McConnell Dowell won A$2.5 billion in new work and grew work in hand to A$3.9 billion at end-January from A$2.5 billion at end-June 2022.

Flanagan differentiated Aveng and McConnell Dowell from the financial troubles experienced by Murray & Roberts (M&R) and WBHO in Australia.

WBHO last year discontinued its financial support of its investments in Australia after experiencing severe challenges in that business over the past decade, with the operating losses and ultimate derecognition of its Australian operations eroding about R4.5 billion in equity over three years.

M&R placed Clough and its Australian holding company in voluntary liquidation in December.

Read: M&R plunges 21% as Australian subsidiary Clough is placed into voluntary administration

The group reported last week that Clough’s voluntary administration had been concluded with agreement reached between the administrators and multinational Italian industrial group Webuild, with Webuild taking effective control of Clough entities and projects from 16 February 2023.

But M&R said that due to the large deficit in Clough’s creditor trust, the voluntary administration of Clough will, as it stands, result in the loss of the group’s investment value in both Clough and its Australian mining business RUC Cementation.

Focused Australian business

Flanagan said Aveng’s built environs business in Australia is a very small element of the group’s business and does not engage in multi-billion, multi-storey high-rise residential blocks across Australia. It is much more focused on opportunities such as school, hospitals and the like, with its customers tending to be government entities.

He said a lot of the contractors who got into difficulty in Australia have been in contracts of A$2 billion and more and have taken minority positions in those projects.

“We do not take minority positions. Our really sweet spot would be on our own up to A$600 million [projects], but we would also partner with tier one contractors on projects up to A$1 billion,” said Flanagan.

“So we are much more focused on where we play and what kind of projects we take on and I think that is what differentiates us from some of our competitors who have lost their way.”

Flanagan is also unconcerned about the steep increase in the group’s work on hand and the ability of its balance sheet to support this growth.

He did however confirm that at recent McConnell Dowell board meetings they discussed slowing down the rate of tendering and focusing more on opportunities the group will need in its 2025 and 2026 financial years.

He attributed this to McConnell Dowell’s planned revenues being 100% secured for its 2023 financial year and 98% secured for its 2024 financial year.

“That is a very good position to be in but we now want to focus much more on the longer-term opportunities across Australia and New Zealand … We are underweight revenue-wise in South East Asia at the moment after turning off our tender machine during Covid-19 and have re-energised and resumed tendering in that environment and hope to grow the revenue in South East Asia in the coming months.”

Work on hand

Aveng group financial officer Adrian Macartney said the group work on hand includes Moolmans and the new R7 billion five-year Tshipi contract in Guinea that was signed in January 2023 and will unwind over a longer period.

Flanagan said 92% of the contracts in McConnell Dowell are profitable but the Batangas LNG terminal project in the Philippines, which was awarded just as Covid-19 broke, has adversely affected its performance.

He said this project is now in its final stages with expected completion in this financial year.

Aveng continues to negotiate with the client for relief as a consequence of the impact of Covid-19, he added.

Flanagan said four of Moolmans’ five contracts achieved an operating margin in line with their aspirations but the business was unfortunately negatively impacted by significant losses incurred on the now terminated old Tshipi contract.

He said the new contract was concluded on commercially viable terms and has facilitated a R900 million investment in new plant and equipment, which will be delivered and commissioned in the next six to nine months and should result in a significant improvement in both production and performance.

Moolmans work in hand grew to R7.8 billion at end-January 2023 from R3.1 billion in June 2022.

Aveng on Tuesday reported a 15.4% increase in group revenue to R15 billion in the six months to end-December from R13 billion in the previous corresponding period.

Operating earnings declined by 15.8% to R181 million from R215 million.

Headline earnings per share improved significantly – to 61 cents from 14 cents.