Asian shares rose and US equity futures were steady ahead of the Federal Reserve’s much-anticipated interest-rate decision later Wednesday.

Stocks climbed in China, Japan and Australia, along with contracts for the region-wide Euro Stoxx 50, as concerns over global financial stability eased. Hong Kong’s Hang Seng Index advanced around 2%, helped along by further gains for Geely Automobile Holdings Ltd. shares after it topped profit estimates.

Australian and New Zealand government bond yields moved higher, while those on Treasuries fell slightly. The decline for US yields came after a surge on Tuesday that added 19 basis points to the two-year yield and 12 basis points to the 10-year benchmark.

The Australian dollar strengthened against the greenback in an otherwise muted day for currencies. A Bloomberg index of the dollar was little changed.

The mix of rising stock prices and a broadly calm Treasuries market indicated fresh appetite for risk taking as investors looked to signs of stability after the collapse of three US banks and UBS Group AG’s takeover of Credit Suisse Group AG.

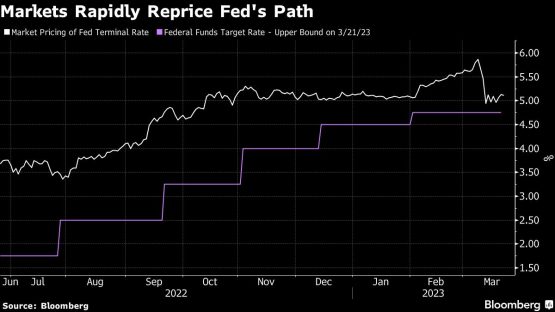

Traders placed greater odds that the Fed will raise interest rates 25 basis points after market pricing was split between a hike and a pause earlier in the week. Officials at the central bank were set to issue updated rate projections for the first time since December, offering guidance on whether they still expect any additional increases this year.

“The failures of banks that we’ve seen so far are idiosyncratic,” Yuting Shao, macro strategist for State Street Global Markets, said in an interview with Bloomberg Radio. She expects the Fed to increase interest rates by 25 basis points on Wednesday. “Once we look beyond the current volatility, restrictive policy staying for a bit longer is still warranted.”

Every stock in a measure of US financial heavyweights climbed Tuesday. Shares in First Republic Bank fell 9% in after-hours trading after the stock surged almost 30% in its best day ever. The gain came amid optimism over a new plan under discussion to aid the regional lender. Further intervention to shore up the bank may include US government backing, people with knowledge of the situation said.

“This is an easier market backdrop,” said Nicholas Colas, co-founder of DataTrek Research. “Expectations of a dramatic about-face for monetary policy are diminishing.”

Still, many were unwilling to sound the all-clear on the financial stability concerns of the past weeks. Michael Wilson Morgan Stanley’s chief US equity strategist, said the risk of a credit crunch is increasing materially. Bank of America’s latest global survey that polled fund managers between March 10-16 showed a systemic credit event has replaced stubborn inflation as the key risk to markets.

Elsewhere in markets, Hong Kong’s monetary authority said a recent surge in the city’s interbank funding rates was spurred by demand for the local currency amid market volatility and quarter-end needs. The cash squeeze eased on Wednesday following Tuesday’s jump in the overnight cost to borrow, which was the biggest since Bloomberg started compiling the data in 2006.

West Texas Intermediate slid, trimming some of its gains from rallies on Monday and Tuesday. The energy sector led gains in Australian shares Wednesday, echoing the sector’s lead in the S&P 500 on Tuesday.

Key events this week:

- US Treasury Secretary Janet Yellen to appear at Senate subcommittee hearing, Wednesday

- FOMC rate decision, news conference from Chair Jerome Powell, Wednesday

- EIA crude oil inventory report, Wednesday

- Eurozone consumer confidence, Thursday

- BOE interest rate decision, Thursday

- Swiss National Bank rate decision and press conference, Thursday

- US new home sales, initial jobless claims, Thursday

- US Treasury Secretary Janet Yellen testifies to a House Appropriations subcommittee, Thursday

- Eurozone S&P Global Eurozone Manufacturing PMI, S&P Global Eurozone Services PMI, Friday

- US durable goods, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 1:28 p.m. Tokyo time. The S&P 500 rose 1.3%

- Nasdaq 100 futures rose 0.1%. The Nasdaq 100 rose 1.4%

- Japan’s Topix rose 1.9%

- Australia’s S&P/ASX 200 rose 1%

- Hong Kong’s Hang Seng rose 1.9%

- The Shanghai Composite rose 0.3%

- Euro Stoxx 50 futures rose 0.3%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0770

- The Japanese yen was little changed at 132.44 per dollar

- The offshore yuan fell 0.1% to 6.8855 per dollar

Cryptocurrencies

- Bitcoin rose 0.3% to $28 232.22

- Ether was little changed at $1,801.28

Bonds

- The yield on 10-year Treasuries declined three basis points to 3.58%

- Australia’s 10-year yield advanced 16 basis points to 3.35%

Commodities

- West Texas Intermediate crude fell 0.5% to $69.29 a barrel

- Spot gold was little changed

© 2023 Bloomberg