A gauge of Asian shares fell as concerns persist over the path of global monetary policy and the health of US banks. New Zealand’s dollar rallied and the nation’s stocks retreated after the central bank raised interest rates by more than expected.

MSCI Inc.’s regional benchmark was set to end a six-day rally as it slipped about 0.5%, with almost all sectors traded in the red Wednesday. Contracts for US equities were little changed after the S&P 500 dropped on Tuesday, dragged down by shares of financial heavyweights. Chinese markets are closed for a holiday.

A measure of greenback strength was little changed as most major currencies traded in narrow ranges. weakened against most. The New Zealand dollar jumped to the highest level since mid-February following the unexpected 50-basis-point rate hike. The nation’s two-year government bond yields surged about 12 basis points.

The Australian currency gave up its advance and the policy-sensitive three-year government bond yield fell fell. The governor of the Reserve Bank of Australia said Wednesday that rates may still rise. The RBA paused its tightening cycle on Tuesday.

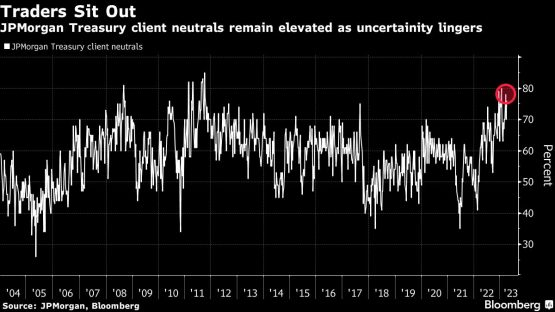

Meanwhile, the two-year Treasury yield ticked higher after declining 14 basis points in the US session as data showed a drop in job openings. That bolstered bets the Federal Reserve will soon wrap up its tightening campaign. Treasuries underwent one of the most turbulent quarters in years in the period through March as traders debated the outlook for inflation amid fears of contagion from the banking sector’s turmoil.

Swap contracts downgraded the odds of a quarter-point rate hike at the Fed’s May meeting easing to around 50% from closer to 60%.

Bond markets are dealing with uncertainty as to what central banks will do, according to Vasu Menon, executive director of investment strategy at Oversea-Chinese Banking Corp. in Singapore. “How much more can they do because they’ve done a lot and inflation is not showing a big fall back to the 2% to 3% targets that most of them have,” he said on Bloomberg Television.

Banks came under renewed pressure Tuesday, with a gauge of financial heavyweights in the US falling the most in almost two weeks. In a wide-ranging annual letter to shareholders, JPMorgan Chase & Co.’s chief Jamie Dimon warned the US banking crisis that sent markets careening last month will be felt for years.

“I think Jamie is correct in the sense that this may not be the last shoe to drop,” Amy Kong, chief investment officer at Barrett Asset Management, said on Bloomberg Television. “There will be broader ramifications to stock market prices as well as earnings.”

Vacancies at US employers sank in February to the lowest since May 2021, the Labour Department’s Job Openings and Labour Turnover Survey showed Tuesday. The reading was below all estimates in a Bloomberg survey.

Elsewhere, oil extended its rally with West Texas Intermediate rising past $81 a barrel. Gold was steady and Bitcoin trended above the high end of its recent range of around $28,000.

Key events this week:

- Eurozone S&P Global Eurozone Services PMI, Wednesday

- US ADP employment change, Wednesday

- US trade, Wednesday

- US initial jobless claims, Thursday

- St. Louis Fed President James Bullard speaks, Thursday

- US unemployment, nonfarm payrolls, Friday

- Good Friday. US stock markets closed, bond markets close for part of the day

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 1:39 p.m. Tokyo time. The S&P 500 fell 0.6%

- Nasdaq 100 futures were little changed. The Nasdaq 100 fell 0.4%

- Japan’s Topix index fell 1.9%

- Australia’s S&P/ASX 200 Index was little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0955

- The Japanese yen was little changed at 131.70 per dollar

- The offshore yuan rose 0.1% to 6.8712 per dollar

- The Australian dollar was little changed at $0.6746

- The New Zealand dollar rose 0.5% to 0.6347

Cryptocurrencies

- Bitcoin rose 1% to $28,537.97

- Ether rose 1.7% to $1,910.17

Bonds

- The yield on 10-year Treasuries was little changed at 3.35%

- Australia’s 10-year yield declined three basis points to 3.23%

Commodities

- West Texas Intermediate crude rose 0.4% to $81.04 a barrel

- Spot gold rose 0.1% to $2 022.92 an ounce

© 2023 Bloomberg