A banner year for stocks is drawing to an end, with the market near all-time highs amid the artificial-intelligence exuberance and dovish US Federal Reserve wagers.

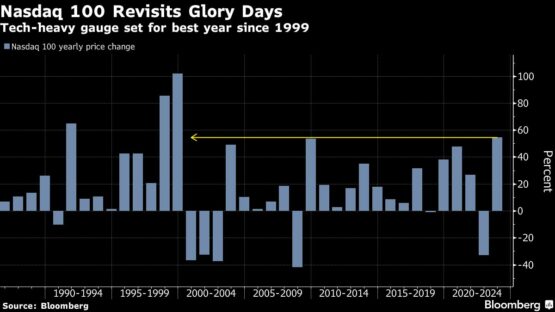

In the run-up to the final closing bell of 2023, the Nasdaq 100 wavered – while still set for its best year since 1999 after a $7 trillion surge. The S&P 500 came close to a record, and was 1% below the average full-year gain predicted in a recent survey with analysts, who forecast the index would end 2024 at 4,833.

ADVERTISEMENT

CONTINUE READING BELOW

“If the stock market can break through that record high in any significant way as we move through January, it’s going to be very bullish on a technical basis,” said Matt Maley at Miller Tabak + Co. “Whenever the market is rallying strongly at the beginning of a new year – when a lot of people are adjusting their investment-game plans – it tends to exacerbate the rally.”

In a rates-obsessed world, the stock market saw a massive reversal this year after suffering its worst annual sell-off since 2008.

As traders ramped up bets the Fed is done with its hiking campaign – and will start easing policy in 2024 – global bonds were set for their biggest two-month gain on record.

The S&P 500 traded just a few points away from its all-time high of 4,796.56 – extending its 2023 advance to 25%. Treasuries dropped after a weak $40 billion sale of seven-year notes. The dollar rose against most of its developed-market peers. The yen climbed as Bank of Japan Governor Kazuo Ueda continued to prepare the ground for the nation’s first rate increase since 2007.

From Nvidia to Microsoft, the seven-largest US tech stocks were responsible for 64% of the gauge’s rally this year through last week as the AI frenzy took off. The Nasdaq 100 is up over 50% this year.

The ‘Magnificent Seven’ – which also includes Amazon, Apple, Google parent Alphabet, Meta Platforms and Tesla – are expected to post 22% earnings growth next year, twice the S&P 500’s advance, data compiled by Bloomberg Intelligence show. The key is how much of that is already baked into share prices, especially with expectations for a soft landing building.

“Companies that have a defined and clear AI strategy with easy-to-follow metrics will likely continue to do well in 2024,” said Michael Landsberg at Landsberg Bennett Private Wealth Management. “Companies that have a hard time explaining their AI value proposition will not see a repeat of 2023, where most large tech was buoyed by the excitement and not necessarily the details of AI.”

Investors have flocked to big tech in part on bets that they are best positioned to capitalise on AI due to their vast scale and financial strength.

Those bigger profits have brought valuations down from nosebleed levels – but they’re still lofty.

The Nasdaq 100 is priced at about 25 times profits projected over the next 12 months, according to data compiled by Bloomberg. While that’s down from a peak of 30 in 2020, it’s well above the average of 19 times over the past two decades.

Although there has been a relatively high number of stocks with gains of over 100%, there haven’t been many outperforming the S&P 500, Bespoke Investment Group noted. In a typical year, on average, 48.7% of the benchmark’s members post larger gains than the index itself. In 2023, less than 30% of its members are outpacing the index.

“This leads one to question whether the leaders (or laggards) continue to lead (lag) in the year ahead,” the Bespoke strategists said. “Looking at the past, the picture is not exactly favourable for that sort of rotation in either direction.”

The market is “sitting on big gains” and most participants just want the year to end to register those gains, according to Tom Essaye, a former Merrill Lynch trader who founded The Sevens Report newsletter.

“But I’ve been in this industry long enough to know that when everyone seems to be leaning on one side of the proverbial canoe, it pays to move to the middle.”

Warnings about a market that’s flashing overbought signals have been raising concern about a pullback, with some market observers saying that traders have gone too far, too fast in pricing in a dovish Fed pivot.

ADVERTISEMENT

CONTINUE READING BELOW

While the recent ebbing of inflation is positive for the Fed, some other figures showing economic resilience could fuel consumer spending – working against the central bank’s aim to slow the pace of growth. That poses risks for the bond market heading into the new year.

Falling yields have also driven the dollar lower in 2023, with the greenback on pace for its worst year since the onset of the pandemic. Much of the decline materialized in the fourth quarter on growing wagers that the Fed will sharply loosen policy next year.

The drop in Treasury yields has effectively relaxed financial conditions in the US and “are hardly compatible with sustainably low inflation,” said Ipek Ozkardeskaya, a senior analyst at Swissquote.

“The rally in the sovereign space looks overdone – hence the rally in stocks and the selloff in the US dollar look overstretched,” she wrote in a note.

About a week ahead of the all-important US jobs report, traders were unfazed by data showing initial jobless claims rose to 218,000. Economists forecast a still-healthy 170,000 increase in December payrolls, consistent with resilient labour demand that has been key in powering the economy.

Elsewhere, oil retreated for the fourth time in five sessions as rising inventories at the key US storage hub in Cushing, Oklahoma, partly offset a drop in national stockpiles to paint a mixed picture for demand.

Some of the main moves in markets:

Stocks

- The S&P 500 was little changed as of 4pm New York time

- The Nasdaq 100 was little changed

- The Dow Jones Industrial Average rose 0.1%

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index rose 0.1%

- The euro fell 0.4% to $1.1064

- The British pound fell 0.5% to $1.2730

- The Japanese yen rose 0.3% to 141.40 per dollar

Cryptocurrencies

- Bitcoin fell 2% to $42,525.5

- Ether fell 0.4% to $2,350.53

Bonds

- The yield on 10-year Treasuries advanced five basis points to 3.84%

- Germany’s 10-year yield advanced five basis points to 1.94%

- Britain’s 10-year yield advanced six basis points to 3.49%

Commodities

- West Texas Intermediate crude fell 3% to $71.91 a barrel

- Spot gold fell 0.5% to $2,066.51 an ounce

This story was produced with the assistance of Bloomberg Automation.

© 2023 Bloomberg L.P.