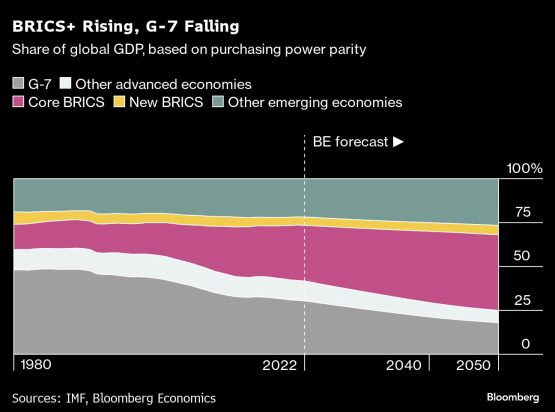

In 2001, Brazil, Russia, India, China and South Africa—the emerging-markets group known as the Brics—accounted for 19% of global gross domestic product in purchasing power parity terms. Today, including countries set to join the bloc, the share is 36%. We see this rising to 45% by 2040, more than double the weight of the Group of Seven major advanced economies.

The rapid rise of the Brics is transforming the global economy. Members are, in general, less democratic and free-market than advanced economies, and growing economic heft could bring a profound shift in influence. Yet the bloc lacks cohesion, and that will stand in the way of ambitious objectives for some in the group—such as challenging the dominant role of the dollar.

ADVERTISEMENT

CONTINUE READING BELOW

Growth math to political project

The Brics started as a simple exercise. Jim O’Neill, then Goldman Sachs’ chief economist, set out two criteria for membership: Countries had to have a large economy already and be set to grow fast. Brazil, Russia, India and China stood out. An additional bonus—the first letter of their names formed a catchy acronym.

The idea proved wildly successful. The original Brics countries delivered stellar growth in the first decade of this century. In an unusual example of geopolitics taking its lead from a Wall Street bank’s research note, they joined forces to form a bloc, which South Africa joined in 2010.

In August this year, the Brics invited six more countries to join: Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the UAE. There’s no new acronym to be found—the group will likely be renamed Brics+. The joiners also stretch O’Neill’s original membership criteria; other more viable candidates remain outside the bloc.

Indonesia, for example, so far isn’t a part of the Brics+ party, but it’s larger than Egypt, Saudi Arabia and the UAE, and set to outgrow two of the three. Both Nigeria and Thailand outperform Iran on both of O’Neill’s benchmarks. Mexico and Turkey are both ahead of Argentina. Ditto for Bangladesh compared with Ethiopia.

The point is clear. The Brics expansion has less to do with economics and more with politics. For the drivers of the expansion, it’s about challenging the dominance of the US, dethroning the dollar as the world’s primary currency, and building alternative institutions to the Washington-centric International Monetary Fund and World Bank.

Economic heft = political influence

Can the Brics achieve this goal? The group has advantages: size, diversity and ambition.

First, the expanded Brics are already larger than the Group of Seven, which comprises Canada, France, Germany, Italy, Japan, the UK and the US. In 2022 the bloc accounted for 36% of the global economy, versus 30% for the advanced economy group. Our forecasts suggest an expanding workforce and ample room for technological catch-up will boost the Brics+ share to 45% by 2040, compared with 21% for G-7 economies. In effect, Brics+ and the G-7 will have swapped places in relative size between 2001 and 2040. Economic heft means political influence.

Second, the bloc will contain some of the world’s largest oil exporters (Saudi Arabia, Russia, UAE and Iran) and some of its biggest importers (China and India). If it succeeds in shifting some settlement of oil transactions toward other currencies, that could have a knock-on effect on the share of the dollar in international trade and global foreign exchange reserves.

Third, denting the dominance of the US currency is clearly one of the ambitions of the Brics+ . China has long sought to boost the yuan’s role in global trade. Brazil’s President Luiz Inácio Lula da Silva called on the bloc to come up with an alternative to the dollar. Russia sees an economic realignment toward China and away from Europe as the only rational option as it continues its war in Ukraine. Under sanctions, it’s already selling oil to China in yuan.

Bric-a-brac

Poke a little below the surface, though, and Brics+ also has some challenges ahead.

Yes, Brics+ is large and growing, but China’s debt problem and real estate correction mean one of the group’s main drivers is fading. The rise of the bloc this century has been largely a story of Beijing’s incredible growth—averaging 9% a year from 2000-2019. That pace is set to fall to 4.5% in the 2020s, 3% in the 2030s and 2% in the 2040s. India might pick up some slack, but neither its economic rise nor its political ambition is likely to match China’s.

ADVERTISEMENT

CONTINUE READING BELOW

Yes, Brics brings oil exporters and importers to the same table, but some are committed to petrodollars. Producers Saudi Arabia and the UAE have currency pegs to the greenback and need dollar reserves to back them. Even without a peg, most countries—unless they’re under sanctions, like Iran or Russia—prefer payments in dollars as the most widely acceptable medium of exchange for international trade.

Within Brics, there’s a reluctance to promote a single alternative. Russia doesn’t want to get rupees from India in exchange for its oil, because of its aversion to accumulating savings in India. How about India paying Russia in Chinese yuan? New Delhi’s geopolitical competition with Beijing means the former wouldn’t want to promote the yuan in global trade.

Finally, the expanded bloc lacks consensus and cohesion. India has a recurrent border dispute with China. Tensions could boil over as India rises and China slows. Saudi Arabia and Iran have long engaged in proxy wars, reflecting a deep divide that recently restored diplomatic ties will struggle to bridge. New Delhi and Riyadh—together with the UAE—signed a memorandum of understanding with the US and Europe to establish an economic corridor that competes with China’s “Belt and Road” initiative.

Shifting center of gravity

How about alternative institutions to the IMF and the World Bank? Again, this will likely remain more of an aspiration than reality. The New Development Bank—the Brics’ answer to the World Bank—has disbursed few funds. The Brics Contingent Reserve Arrangement—the supposed competitor to the IMF—is small and of limited use.

The idea of a single Brics currency, with unified monetary policy, looks especially unlikely today. Brazil is cutting interest rates, Russia is raising them aggressively, and the UAE and Saudi Arabia mimic whatever the US Federal Reserve does. If the euro area is struggling with a “one size fits all” currency and monetary policy, the Brics wouldn’t be able to find that one size to begin with.

That’s not to say the incredible rise of Brics will be without consequences for the global economy. The center of gravity will shift toward the East and the South, where governments score low marks on representation and intervene more heavily in markets compared with the West.

Of the Brics+ countries, only the political systems of Argentina, Brazil and South Africa earned a top “free” score from Freedom House last year. India was rated “partly free,” while China, Egypt, Ethiopia, Iran, Russia, Saudi Arabia and the UAE were “not free.” The share of global GDP from countries classified as “partly free” or “not free” has already increased from 24% in 1990 to 49% in 2022. By 2040 our forecasts suggest it will have risen to 62%.

Things look even bleaker for advocates of unfettered markets. The Heritage Foundation, an American conservative think tank, rates almost all the Brics+ economies as “mostly unfree” or worse. The G-7 economies are rated “mostly free” or “moderately free.” The share of global GDP from economies Heritage classifies as “mostly unfree” or “repressed” has already risen from 27% in 1995 to 44% in 2022. By 2040 our forecasts suggest it will have risen to 56%.

The Brics will change the world, but perhaps more because of their rising share of GDP and divergent political and economic systems than through the realisation of policymakers’ grand plans.

© 2023 Bloomberg