In the wreckage of China’s stock-market meltdown, some traders are making longshot bets that officials in Beijing can stoke a recovery.

They’re finding moments to snap up options tied to US-listed exchange-traded funds that track Chinese equities, which have been whipsawed by Covid lockdowns, regulatory pressure and a property crisis. It’s evidence that market participants – who’ve seen shares from Beijing to Hong Kong slump 60% from a 2021 peak – want to be able to capture the upside for the stocks, just in case the government eventually succeeds in stoking a rebound.

ADVERTISEMENT

CONTINUE READING BELOW

“It’s simply buying cheap lottery tickets with a potentially big payout,” said Charlie McElligott, managing director at Nomura Securities International. The worse Chinese stocks fare, “the more attractive it becomes from a risk-reward perspective,” he said.

With Chinese leaders keen to stop the stock-market selloff, the bets in ETF options are proof that at least a few investors are taking notice. Even if most traders are too shy to buy the equities outright, and many are actively avoiding them, options offer a way to maximize profits while minimizing potential losses.

Plus, US-based ETFs are trading as some local financial markets shutter for the Lunar New Year holiday.

China’s stocks have been among the world’s worst performers over the past three years as protracted Covid lockdowns, regulatory crackdowns in areas such such as technology and education, and a rolling property crisis have sapped investor confidence. An index of mainland shares listed in Hong Kong has slumped nearly 7% this year alone, though the gauge gained 1.5% Wednesday as it reopened after Lunar New Year.

Bullish wagers

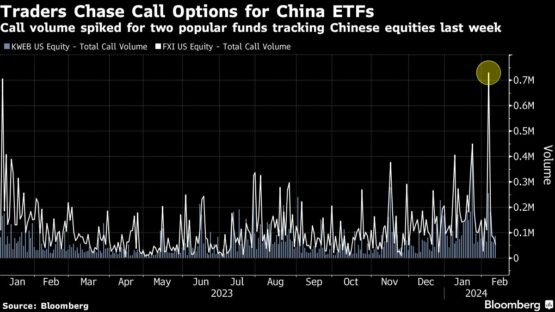

Call options volume — which typically indicates investor interest in bullish wagers on an asset — spiked last week to the highest in more than a year for the $4.2 billion iShares China Large-Cap ETF, known as FXI. Similar trends emerged across the $20 billion market of US-listed ETFs focused on China in recent weeks, driven at least partly by traders who fear missing out on any potential recovery.

Upticks in options activity have been spurred on as President Xi Jinping’s government pushed curbs on short-selling domestically, opted for state buying of shares in the nation’s largest banks and even replaced the head of the nation’s securities regulator. The government also said it was buying up shares in locally-listed ETFs.

While call options volume has slipped back amid the holiday lull, traders are still on the lookout for the next catalyst for shares to swing — even if overall sentiment among investors remains sour. At times, Beijing’s stimulus vows have produced short bursts of market gains. FXI shot 4.4% higher last week amid the latest round of measures — though it’s still down 5.7% so far this year.

Timing the trade

Buying has increased most in shorter-term contracts as risks, such as the US presidential election, linger further out on the horizon. Among the 10 contracts for FXI with the largest open interest, nine are calls expiring in February and March that allow the holders to buy shares between $22 and $30.

Evercore ISI, for example, recommended clients buy call options for FXI that expire March 28 to take advantage of Chinese equities’ low valuations. That gives traders a way to bet on more stimulus between now and March, when Beijing is set to hold its National People’s Congress meeting. Goldman Sachs Group Inc. has also touted option trades on Chinese assets.

ADVERTISEMENT

CONTINUE READING BELOW

“Call options, which are by no means expensive on a volatility basis, are an excellent way to play this theme,” said Julian Emanuel, senior managing director of equities, derivatives and quantitative strategy at Evercore. “Limited risk, theoretically unlimited reward.”

Memories of tense US-Sino relations under former President Donald Trump, however, are discouraging bets with time horizons closer to the US presidential election.

In another closely tracked metric, the FXI’s one-month put-versus-call skew inverted several times in recent weeks, with options betting on a rally costing more than bearish contracts. To Ling Zhou, head of equity derivatives strategy at TD Cowen, that is an indication that traders have been using options to catch a rebound.

He expects traders to be prepared for significant swings in Chinese equities in the year ahead, pointing out that the cost of one-year options on FXI is trading at 10-year highs compared to those of the SPDR S&P 500 ETF Trust, an ETF that tracks the S&P 500.

“Buying call options is a way to gain exposure without committing a significant amount of capital,” said Malcolm Dorson, head of emerging-market strategy at Global X Management Co.

© 2024 Bloomberg