The best short call of 2023 wasn’t made by a ruthless hedge fund, a well-known activist firm, or any of the liveliest voices on the sell side. It was made by a first-year medical resident running a blog named after a SpongeBob SquarePants character.

James Block is a physician at one of America’s top hospitals, but between shifts he moonlights as an amateur financial sleuth and writer. His personal mission: expose the cryptocurrency market for being what he describes as “a semi-decentralised pyramid scheme.”

ADVERTISEMENT

CONTINUE READING BELOW

Plenty would dispute that characterisation, and his quest looks increasingly like an uphill battle following the US approval of spot Bitcoin ETFs this month. Yet the 31-year-old hobbyist has won notable victories — including last year’s best bearish call.

Block (no relation to famous short seller Carson Block) stumbled onto Signature Bank during his investigations in the crypto world. The regional lender was doing big business with companies in the industry, working with multiple characters he considered suspect and with huge exposure to questionable digital assets.

“I saw just how careless they were being with who they were doing business with, with the amount of money that they were holding, the amount of uninsured deposits they had,” Block says from his home office near Ann Arbor, Michigan.

That spurred him to publish a damning critique of Signature on his blog, Dirty Bubble Media, on January 10, 2023. A little over two months later the lender was shut down, becoming at the time the third-largest bank failure in US history.

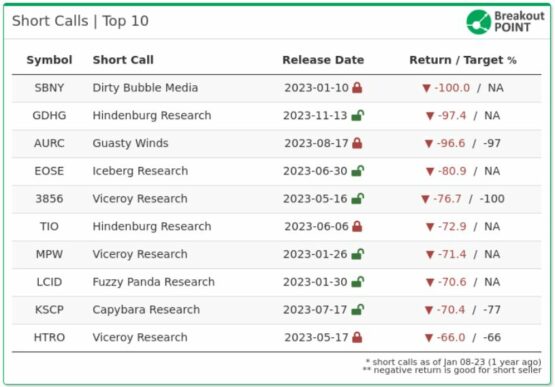

Signature’s demise came amid a broader US banking crisis that began with a run on Silicon Valley Bank, and given the worries surrounding the industry it’s unlikely Block was the only person to spot trouble brewing. But he was one of the few to publish concerns focused on Signature specifically, and the subsequent 100% wipeout in its shares made Dirty Bubble’s bearish call the best of the year, according to Breakout Point, an analytics firm that tracks short-selling campaigns.

That puts Block atop a list that includes the likes of Nate Anderson’s Hindenburg Research and Fraser Perring’s Viceroy Research.

Read: Criminal complaint filed against Viceroy’s Fraser Perring

FTX takedown

With a subscriber base of about 20 000, the Dirty Bubble Media blog has little of the clout enjoyed by more famous short sellers, who can often send a stock spiralling the instant they publish research. But Block’s one-man campaign to “destroy these frauds” in the digital asset space has attracted influential readers, including hedge funds and even regulators, he says.

Many of those were won after he helped expose fraud at Sam Bankman-Fried’s cryptocurrency exchange FTX and trading firm Alameda Research. The Dirty Bubble post “Is Alameda Research Insolvent?”, in which Block patiently explained the likely scam underway, was a viral hit in the days leading up to the collapse of both firms.

The top 10 short calls tracked by Breakout Point in 2023.

The name Dirty Bubble was taken from one of the antagonists in the SpongeBob TV show. Block says he chose it because he knew he was destined to be a bad guy in the eyes of the crypto faithful, and he was right. They’ve accused him of everything from outright lies to working for Wall Street’s big banks in an effort to derail digital assets. (“If that’s true, I wish they would send me a check,” he says.)

Exactly how correct he is about the legality and integrity of the digital-asset space is up for debate. While Bankman-Fried was convicted of one of the biggest-ever financial frauds following the fall of FTX and Alameda, and other high-profile crypto firms like Celsius Network have failed, advocates see these as inevitable growing pains for a nascent industry.

ADVERTISEMENT

CONTINUE READING BELOW

In this view, the arrival of spot Bitcoin ETFs — so long delayed by financial watchdogs in part because of concerns about market manipulation — signals a growing regulatory acceptance and shift into the mainstream. Almost a dozen such products started trading earlier this month, with some $4.6 billion of shares changing hands in their first session — a huge level of activity for debut funds.

‘Pyramids and ponzis’

Block says he started betting against Signature personally with “pocket change” in 2022 based on its exposure to crypto and his own view of the precariousness of the digital-asset ecosystem. Ultimately, the lender failed not directly because of its cryptocurrency deals but because panicked depositors began withdrawing billions following the demise of SVB and Silvergate Bank — two similarly crypto-friendly institutions.

It’s impossible to say how many others spotted the growing risks. Plenty of professional short sellers never publicize their positions or research, and hedge funds typically don’t disclose their bets.

Meanwhile, measuring each call by the calendar year can be a flawed process, since many can take months or years to play out. And gauging success by the share decline is imperfect, since in reality other factors would influence short selling returns, such as cost to borrow stock.

Still, Block’s was the top call from 129 tracked by Breakout Point in 2023, the analytics firm said. Dirty Bubble was one of almost a dozen new short activists it counted last year.

Other calls by Block have fared less well so far. In March, Dirty Bubble published a report describing Coinbase Global as a “cash-burning regulatory nightmare.” In April, the blog explored problems underlying the business model of the Charles Schwab Corp. Though the shares of both companies are off to a miserable start in 2024, they’re up more than 85% and 20%, respectively, since the posts appeared.

Block, now a second-year resident in psychiatry at the University of Michigan hospital, considers the collapse of the whole crypto edifice — what he views as little more than a collection of “pyramids and ponzis” — inevitable. In the meantime, faced with the current resurgence, he now views his role as chronicling the madness rather than curing it.

“It sounds kind of depressing, but I recognize how impotent facts are in these kind of scenarios,” he says. “It really doesn’t matter what’s true and what’s not true to people. They only care about what will make them money.”

© 2024 Bloomberg