It’s the year of the soft landing—and of interest-rate cuts that will support growth and markets around the world. So runs the upbeat conventional wisdom about the global economy in 2024.

What could possibly go wrong? After years marked by war, pandemic and bank collapse, it hardly needs saying: a lot. That includes—but is not limited to—the following.

ADVERTISEMENT

CONTINUE READING BELOW

The Middle East is on the brink

After more than three months, Israel’s war in Gaza has brought the region to the brink of a wider conflict with the potential to choke off oil flows, take a chunk out of global growth, and push inflation higher again. That kind of energy-supply disruption hasn’t happened yet, and markets are betting it won’t. But the risk is rising.

Tensions have escalated in the Red Sea since the US and UK launched airstrikes in Yemen, a response to weeks of attacks by Houthi militants on vessels in a key gateway for global commerce. Daily exchanges of fire along the Israel-Lebanon border, and the assassination of a Hamas leader in Beirut, risk drawing Hezbollah — and consequently Iran — deeper into the fighting. Iraq and Syria increasingly look like flashpoints too.

Our base case remains that a direct Iran-Israel war is unlikely. If that extreme scenario did materialize then one-fifth of global crude supply, as well as important trade routes, could be at risk. Crude prices could surge to $150 per barrel, shaving about 1 percentage point off global GDP and adding 1.2 percentage points to global inflation.

The Fed could get burned (again) …

That would be bad news for the Federal Reserve, and for investors betting on an early and aggressive pivot to rate cuts.

In the 1970s, Fed Chair Arthur Burns pivoted too early. The result was a resurgence of inflation, requiring extreme measures from his successor Paul Volcker to bring prices under control. There’s two ways 2024 could see a repeat, albeit in miniature. One involves a supply shock — a real possibility if an escalating Middle East conflict hits oil prices and shipping lanes. The other would stem from looser financial conditions – with the five-year Treasury yield down more than a percentage point from its October high.

Plug a one-percentage-point drop in yields into Bloomberg Economics’ model of the US economy, and it nudges inflation in the year ahead up by half a percentage point, bringing it closer to 3% than the 2% target. If that happens, the Fed might have to pause the pivot—frustrating market expectations of an easier policy stance.

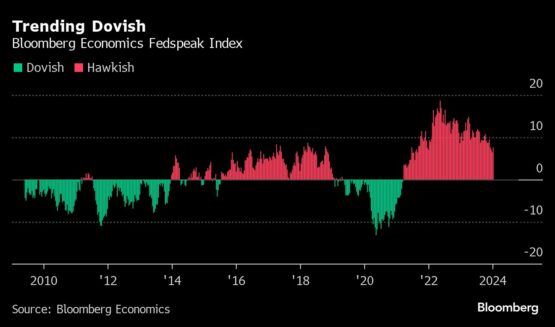

Our new natural language processing model for capturing Fed speaker sentiment shows officials have left themselves a lot of room for manoeuvre. The model — trained on 59 000 news headlines on Fed speeches and press conferences — shows officials trending dovish but still a long way from committing to cuts.

… While Europe feels the chill

If the US risks running its economy too hot, the opposite is true of Europe.

The European Central Bank and Bank of England are at the end of their most aggressive tightening cycles in a generation. Run their hikes through any macroeconomic model, and it spits out a clear forecast: deep recession.

Euro-area gross domestic product should have taken a hit of 2.5%, Bloomberg Economics’ model suggests. The equivalent figure for the UK is 4.7%. So far, the data show something different—a slowdown in both economies, but not a contraction.

Of course, the models may be wrong. Forecasting through the pandemic and Ukraine war was always going to be a challenge. But there’s another possibility. Monetary policy famously operates with long lags. In Europe, the big hit may be yet to come.

For Germany, Europe’s stalled powerhouse, it wouldn’t take much to turn 2024 into another year of contraction. A slowdown in China adds to the risks. Bad news for China—slower growth—is bad news for Germany, which counts the Asian superpower as one of its biggest export markets. Good news for China—the rise of its electric-car makers—is also bad news for Germany, because Volkswagen AG and its compatriots fear that Chinese rivals such as BYD are in their lane.

Which consensus 2024 trades look best so far and which are already getting stale? Share your views in the latest MLIV Pulse survey.

China looks wobbly

The world’s second-largest economy enters 2024 with growth already heading south. The post-pandemic recovery has fizzled, and a steady drip of stimulus has failed to fill the vast hole left by a slumping property sector.

Bloomberg Economics’ base case is that Beijing will ultimately deliver enough support to stave off collapse, with growth for 2024 forecast at 4.5%. That would be down from last year, and far below the pre-pandemic norm, but not a disaster.

Risks are tilted firmly to the downside. If stimulus arrives a day late and a dollar short and the property slump deepens, growth could slow to around 3%. If real estate woes trigger a financial crisis, as they did in Japan in 1989 and the US in 2008, the economy could even shrink, in reality if not in the official statistics.

In Japan, 2024 is set to be the year when the under-new-management central bank ditches yield curve control, the policy it used to peg long-term interest rates at rock-bottom levels.

The goal was to reflate Japan’s shrinking economy. The effects have rippled around the world in the form of the carry trade. Investors could borrow in yen with a zero-cost guarantee, and then buy US Treasuries paying 4% or emerging-market bonds yielding even more. Yen depreciation pushed the profits on that trade higher still.

Bloomberg Economics sees the Bank of Japan moving toward an exit in July, keeping policy settings accommodative but removing the lock on yields. Careful signalling to the market increases the odds it will go smoothly. If it doesn’t, and the yen spikes, carry trades could unwind rapidly with an exodus of funds from US Treasuries and other higher-yielding assets. The sums involved are vast: Japan has $4.1 trillion of foreign portfolio investment.

Ukraine at a tipping point

After the failure of Ukraine’s counteroffensive, Western backers warn the country risks outright defeat—especially if US military aid were to dry up, handing Russia a decisive battlefield advantage.

Stalemate may be a likelier outcome. The record of past conflicts shows the longer they go on, the less likely the aggressor will achieve a decisive victory. Still, Eastern European governments now worry aloud about the arrival of an emboldened Russian army on their borders—and whether it would stop there. Analysts say the US might face a tough choice between deploying forces to deter Russia in Europe, or China in Asia.

A defeat for Ukraine could make it harder for Washington to convince other countries that it’s a strong and reliable ally. It might also increase the likelihood of blowups elsewhere in the world—the recent flareup of a territorial dispute between Venezuela and Guyana is one example—as weaker US deterrence encourages regional powers to settle old scores or create new facts on the ground.

Game-changing elections in Taiwan …

ADVERTISEMENT

CONTINUE READING BELOW

In Taiwan, last weekend’s presidential vote saw Vice President Lai Ching-te win by a narrow margin, granting his ruling Democratic Progressive Party (DPP) an unprecedented third term. Mainland China’s immediate reaction was muted, stopping short of major military exercises or economic measures.

Beijing may see the DPP’s failure to secure a legislative majority as constraining Lai’s administration, allowing a less intense reaction. However, deep Chinese scepticism of the president-elect as a “separatist” and “troublemaker,” despite his pledge of cross-Strait policy continuity, means trust is low, opening the door to a potential escalation in tensions in the months ahead.

The stakes for the world economy are high, especially because of Taiwan’s key role in semiconductor output. War in the Taiwan Strait isn’t a high probability. If it does occur, Bloomberg Economics estimates choked chip supplies, blocked trade routes, and economic sanctions could cost as much as 10% of global GDP, dwarfing the impact of even such major shocks as the global financial crisis and the pandemic.

A war is an extreme scenario. Higher stress stopping short of conflict is more likely, exposing market champions like Apple and Nvidia – that count Taiwan Semiconductor Manufacturing Co. among their crucial suppliers – to geopolitical risk.

… And in the US

The most important election of 2024 could upend calculations around the world. November’s US presidential vote is shaping up as a rematch between Joe Biden and Donald Trump, who’s grabbed an early poll lead in swing states.

Trump’s return to office could bring sharp policy reversals in 2025, and markets might price them earlier. He’s promised a tariff of 10% on all imports. If trade partners retaliate in kind, that would shave 0.4% off US GDP, Bloomberg Economics estimates. There’ll be more trade tension with partners like Europe and rivals like China. America’s desire to lead the NATO military alliance could diminish.

Before any of that, there’s the election itself to get through and a significant risk that its outcome could be contested. The post-vote violence on Jan. 6, 2021, showed the potential for domestic upheaval and the fragility of faith in US democracy.

What could go right? Oil, for one …

After years when apparently low-probability scenarios turned into market-shaking realities, perhaps the best good news in 2024 would be if the risks remained as risks.

Beyond that, energy markets could be one place to look for a positive growth surprise, provided a wider Middle East war can be averted. Oil should have surged in 2023—demand was strong, and OPEC+ slashed supply—but instead it fell. If the conflict in Gaza stays contained, conditions in 2024 may be conducive to further declines.

Demand growth is set to slow, and OPEC+ could struggle to stay united, raising the prospect of a price war that would lift the global economy. Bloomberg Economics estimates that a 10% drop in oil prices would boost world GDP by close to 0.1 percentage point.

And some emerging markets could thrive …

Two trends are generally favourable for emerging markets going into 2024: Interest rates are falling, and companies are seeking to bring their supply chains nearer to home.

A handful of countries are well placed to catch both tailwinds at once, led by Mexico, Peru and Poland. They’re all poised to cut rates in 2024— the latter two already started—and have trade arrangements with large neighbors that make them prime sites for nearshoring.

… Even these long-troubled ones

Major policy pivots in Argentina and Turkey might make two troubled economies investable again.

In Argentina, President Javier Milei’s shock therapy will hurt in the near term as a currency devaluation is followed by drastic budget belt-tightening. There remains a danger that the country, where prices rose more than 200% last year, will tip into outright hyperinflation. Bloomberg Economics model flags a 5% chance price gains could approach 2,000%

Still, if Milei’s program succeeds then the seeds of faster, more balanced growth will have been planted — and investors might stop worrying about another default and start thinking about bargain-hunting.

Since winning reelection in May, Turkish President Recep Tayyip Erdogan has countenanced a policy pivot. His unorthodox and unsuccessful recipe for fighting inflation with cheap money is out. Jumbo rate hikes and tighter banking regulation are in. Investor interest is picking up, which bodes well for the lira.

Still, the base case isn’t great

There are things that could go right. There’s more that can go wrong.

Even before the downside risks, Bloomberg Economics’ base case is for global growth in 2024 of just 2.7%. That’s far below the pre-pandemic run rate of 3.4% and the lowest in a noncrisis year since the dot-com bubble burst in 2001.

An economy that’s already wobbling is easy to knock over.

© 2024 Bloomberg