Britain’s biggest banks have a new problem on the horizon: car loans.

The Financial Conduct Authority has reached out to around a dozen banks about their auto lending practices, according to people familiar with the matter. The moves come as the regulator said last week it had begun an investigation into how some of these products were sold — a push that analysts say could land banks with a bill of as much as £10 billion ($13 billion).

ADVERTISEMENT

CONTINUE READING BELOW

For decades, lenders including Barclays Plc, Lloyds Banking Group Plc and the UK arm of Spain’s Banco Santander SA have made big money from funding car purchases. Now, the FCA is looking at whether customers were told about the amounts of commission paid to the dealerships.

About a dozen auto finance lenders received orders from the regulator to begin so-called Section 166 reviews before Christmas, according to people with knowledge of the situation. These reviews force a firm to bring in an outside expert to examine their practices and produce and independent report for the authorities, which can then taking further action if necessary. A spokesperson for the FCA declined to comment.

While lenders would have their own internal minimum rate to finance a car purchase, dealers could earn thousands of pounds for themselves, and the bank, by pushing up the interest rate, a practice known as the “overage.” Many consumers have complained they were not aware of the availability of the lower rate and the way the overages worked, the regulator said.

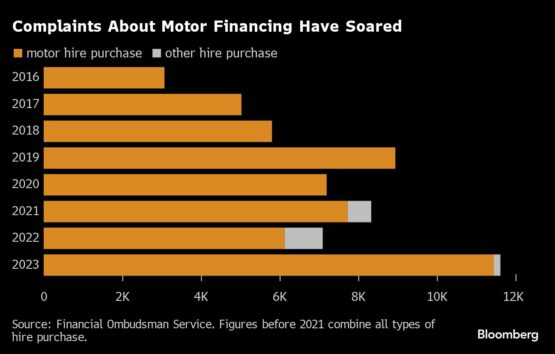

A smattering of test cases through the Financial Ombudsman Service, a government unit that handles customer complaints, have already led to refunds. Andrew Smith, chief executive officer of Paxen Group, a UK regulatory compliance advisory firm, said the ombudsman’s findings suggested there was a strong likelihood that lender, brokers and others involved in the sale of motor finance products could end up compensating borrowers.

“I’m not convinced it’s just the lending organization that will end up on the hook,” said Smith.

Analysts are warning this could be a major problem for the banks. Keefe, Bruyette & Woods said that Lloyds, the UK’s biggest auto finance provider, could face a bill of around £1.2 billion, while Royal Bank of Canada said in a note to clients that while details were scant, the potential compensation costs for the industry could reach between £2 billion and £8 billion — and in the worst case £10 billion.

Shares in several banks fell last Thursday with the FCA’s announcement as investors weighed up the seriousness of the issue. Close Brothers Group Plc, a smaller UK lender with an outsize exposure to car loans, dropped nearly 11% on the day, while shares in Lloyds and Barclays lost more than 3% of their value.

The FCA ordered a pause until late September on new complaints while it decides what actions, if any, are needed to deal with the growing caseload.

“The new rules will help us ensure our approach to providing any redress that is due to these customers leads to the right outcomes for consumers and the effective functioning of the motor finance market,” said the FCA in its statement last week.

Concerns over car finance are not new. Seven years ago, the FCA warned about increased use of personal contract purchases in new and used car sales, which had risen from 34% of the market in 2008 to 66% by 2017, turbocharged by the ultra-low interest rates available to lenders.

Under these deals, a buyer essentially borrows against the forecast decline in vehicle’s value over the life of the contract with the option to purchase the vehicle outright at the end — or, more often than not, to take out a new deal to buy their next car.

ADVERTISEMENT

CONTINUE READING BELOW

Three years ago, the authority banned commissions that incentivized motor finance dealers and brokers to increase a customer’s borrowing costs.

In a statement, a spokeswoman for Lloyds said: “We are currently reviewing the FOS decision and will work collaboratively with the FCA on their upcoming review.”

Barclays said: “While we haven’t offered car financing since 2019, we are working with the Financial Ombudsman Service and Financial Conduct Authority to resolve historic complaints relating to these types of loans.”

Santander UK said: “We welcome the clarity which the FCA’s intervention on this important issue will bring for both customers and motor finance firms alike.”

A spokesman for Close Brothers declined to comment.

Martin Lewis, a consumer rights activist and the founder of MoneySavingExpert.com, wrote a post on X that motor finance had echoes of PPI, the payment protection insurance misselling scandal over a decade ago that cost the UK banking industry more than £38 billion ($48.4 billion) in compensation.

“The pay out would be either the interest on loans (which is big), the commission (which is big), or the whole loan (which is huge),” wrote Lewis. “We’re possibly talking thousands back for many.”

RBC analysts described Lewis’s comments as “unhelpful.

© 2024 Bloomberg