Local chicken producers and importers of frozen bone-in chicken portions are gearing up for the upcoming review to reimpose anti-dumping duties against several key trade partners.

The Association of Meat Importers and Exporters (Amie) published a lengthy report arguing that the duties will have a detrimental impact on consumers and food security.

The South African Poultry Association (Sapa) prepared an equally lengthy report warning against “superficial and overstated” assumptions about chicken price increases due to import duties without a proper analysis of all the factors.

The suspension

The International Trade Administration Commission (Itac) introduced provisional duties against Brazil, Denmark, Ireland, Poland and Spain for six months from January to June last year.

Following input from the affected countries, Itac recommended the imposition of final anti-dumping duties for a period of five years against these countries. Minister of Trade, Industry and Competition Ebrahim Patel agreed that the countries were in fact dumping their produce in the South African Customs Union (Sacu) market, causing material harm to the local industry.

Read:

SA suspends anti-dumping duties on poultry imports [Aug 2022]

Increased dumping of chicken expected, particularly from Brazil [Sept 2022]

However, Patel suspended the imposition of the duties for 12 months until August this year. His reason: the impact of high food inflation on struggling South Africans.

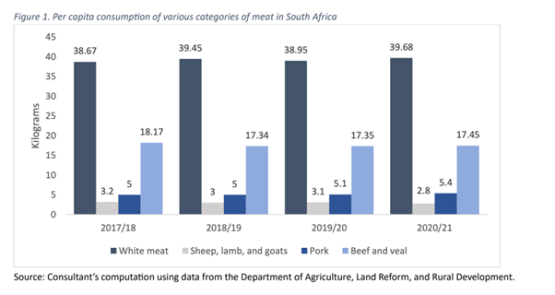

In its report for Amie, Tutwa Consulting highlights the high unemployment rate, the level of poultry consumption compared to other meat products, and the impact of elevated prices on a shift away from poultry to other sources, potentially non-meat sources (see below).

Source: Tutwa Consulting

“To safeguard the domestic industry from implosion, government intervention is required. While there are a myriad of constraints facing the domestic industry … the imposition of anti-dumping duties is one which is in government’s control,” the report says.

“It is therefore recommended that government take action to allow ease of access for chicken meat imports, as this will prevent the collapse of the domestic industry, enhance competition within the domestic market, and ensure that consumers have access to this essential dietary component.”

Tutwa Consulting says in its report that in December 2021 (before the imposition of the provisional duties), the average price per kilogram of chicken products subjected to duties was R18.41. By August 2022 (when these duties were suspended), the price had risen to R22.65.

Consider several factors

Genesis Analytics, at the request of Webber Wentzel on behalf of Sapa, investigated the likely impact of the duties (and their suspension) on the retail price of frozen bone-in chicken portions in South Africa.

It argues that there are several factors that must be considered when determining the extent to which a tariff change can be passed on to consumers.

Read:

Heated debates over imported frozen food

Chicken off the table for poor South Africans after prices surge

It notes that when the provisional duties were in place, imports from European countries declined effectively to zero because of the bird flu import bans from the European Union. “This in and of itself would have significantly diluted the pass-through of the provisional anti-dumping duties onto average import prices,” states the report.

“This suggests one should be very cautious about drawing any strong conclusions about the detrimental effects of these anti-dumping duties on consumers to date as, by [and] large, only one of the five targeted countries (Brazil) has been trading since the provisional anti-dumping duties were implemented (and since the final anti-dumping duties were suspended).”

Retail price

Genesis Analytics also emphasises that a duty is imposed on the free-on-board (FOB) price of imports and not on the final retail price.

“Because the FOB price is typically lower than the retail price, the implication is that any duty will be diluted in the final retail price. The smaller the proportion that the FOB price contributes to the retail price, the smaller the impact that any duty will have on the retail price.”

The firm found that the average FOB price of bone-in imports made up between 36% and 41% of the prevailing retail price for individually quick-frozen (IQF) chicken products, see below.

Source: Genesis Analytics

Other factors that can impact the retail price are the fact that the duties only apply to a limited number of companies in a limited number of countries.

There is competition among producers in the domestic chicken market and competition among retailers – and larger buyers have countervailing power.

The Genesis investigation found that average monthly retail (and producer) prices for frozen bone-in chicken portions were higher – not lower – in the suspension period (July to December 2022) when compared to the provisional period (January to June 2022).

“This is not consistent with the notion that these anti-dumping duties resulted in harmful pass-through for consumers; nor is it consistent with the notion that the suspension of the anti-dumping duties coincided with significant downward pressure on retail prices.”

Warning bells

Tutwa remarks on the existing trade agreements between South Africa, the European Union, the US and Brics.

Brazil is a member of the preferential trade agreement between Mercosur (the Southern Common Market) and Sacu, and is also a member of the Brics group of countries together with Russia, India and China.

“South Africa should carefully consider the consequences of alienating the EU, a major Brics partner, and the US, as they are crucial partners for its economic development,” the Tutwa report warns.

Genesis says the producer margins and profitability of the local industry paint a stark picture of an industry under pressure.

During the provisional period and relative to the six-month prior period before (July to December 2021), the average gross margins related to bone-in portions across six of the largest producers almost halved. This decline in profitability continued throughout the second half of 2022.

Read:

Cash-strapped consumers place pressure on food producers

SA poultry edges closer to being a R60bn industry

Bird flu creeps inland, with virus mutation reported in Mpumalanga