International Monetary Fund Managing Director Kristalina Georgieva said China was coming with more openness to the debt relief talks for stressed developing nations held during the Group of Twenty meetings for finance chiefs.

Participants have spent two days in Gandhinagar, India, to attempt to build on a recent debt-restructuring framework for Zambia and look at ways to reform multilateral development banks and encourage sustainable finance.

It’s growing increasingly unlikely the group will be able to coalesce around a joint communique, or at least a statement on the discussions by the confab’s chair. India is hosting the talks, as rotating head of the G-20 this year.

With no major breakthroughs anticipated at the meetings, outside advisers and the heads of international financial organisations were calling for more concerted action.

IMF says China willing to absorb some Ppain in debt relief talks (3:30 p.m.)

China, the largest official creditor for poorer countries, has shown more openness in the debt relief talks and is willing to absorb some pain, IMF Managing Director Kristalina Georgieva said.

The G-20 members have been deadlocked on debt relief for developing nations, after conceiving a coordinated plan known as the Common Framework in 2020. Beijing in the past has urged multilateral lenders such as the World bank to participate in taking haircuts.

Georgieva said the IMF wants to see faster movement in debt resolution for Ghana, Chad and other countries, saying creditors want treament to be fair.

“Very often there’s a feeling that I’m getting a worse deal than others,” she said.

Godongwana rebuffs ANC call to pressure South African central bank (1 p.m.)

South Africa’s finance minister rebuffed a call by some in the nation’s governing party for him to push the central bank to use measures other than lifting borrowing costs to curb inflation, as he reaffirmed the bank’s independence.

“I’m not in discussion with the central bank on that matter,” Godongwana said Tuesday in an interview with Bloomberg Television at a meeting of Group of 20 finance chiefs in Gandhinagar, India. “The central bank in South Africa, by constitution, is independent and its purpose is defined as that of protecting the value of the currency in the interests of balanced growth.”

ECB’s Visco says inflation may drop more quickly than forecast (10 a.m.)

European Central Bank Governing Council member Ignazio Visco said inflation may come down more quickly than the institution projected last month as falling energy costs continue to affect a broader range of prices.

While inflation measures that strip out volatile items are “stubborn,” lower prices for commodities including natural gas are expected to have a growing impact, Visco told Bloomberg Television on Tuesday.

China’s slowdown is ‘concerning’ for Australia, treasurer says

China’s flagging economic growth is “concerning” for Australia, Treasurer Jim Chalmers said, adding that it’s “quite remarkable” Beijing is grappling with the risk of deflation at a time when most nations are trying to restrain prices.

“It has a substantial impact on how we see prospects for the global economy,” Chalmers said. “China is obviously a big piece of the puzzle for us and so when the data out of China is a bit softer, that is concerning to us.”

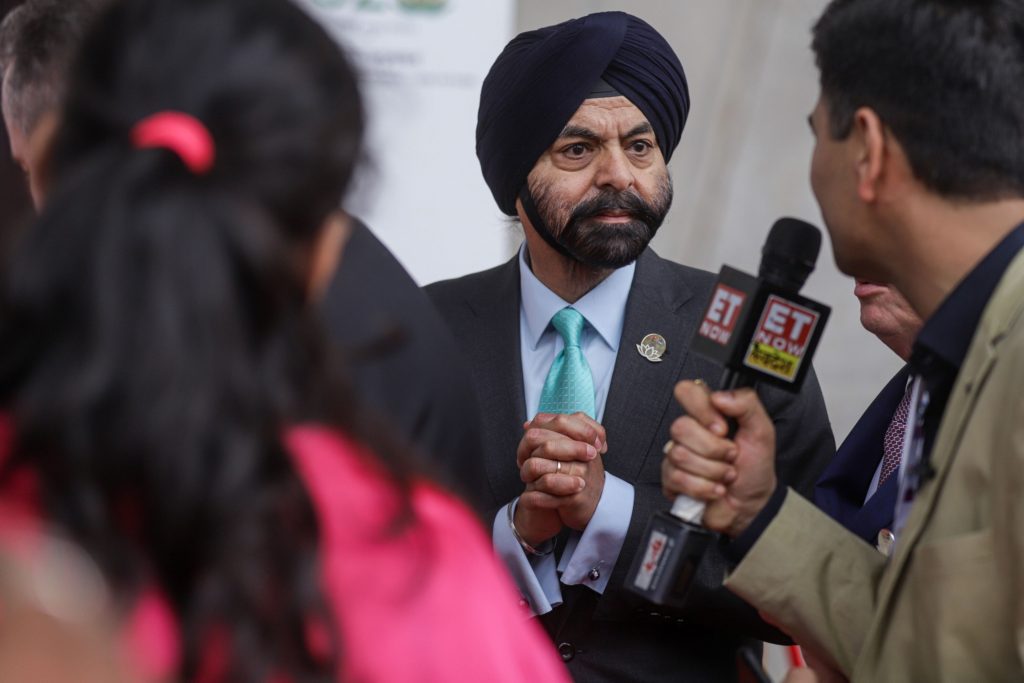

World Bank chief aims to boost lending capacity, keep AAA (9 a.m.)

World Bank President Ajay Banga said his bank is aiming to ramp up its lending capacity while maintaining a top, AAA credit rating.

“We are building a better bank, but eventually we will need a bigger bank,” Banga said in prepared remarks to the G-20 finance chiefs on Tuesday. “I am proud to announce the progress we have already made to stretch every dollar, while preserving our AAA credit rating.”

The lender unveiled three new mechanisms which it said would boost its lending capacity. One is a proposed “portfolio guarantee program” where shareholders of the World Bank will step in if countries cannot repay their loans. The bank said in a statement that $5 in guarantees could generate $30 billion in lending over 10 years.

The second step is “raising hybrid capital from shareholders and other development partners.” This will give “shareholders and partners an opportunity to invest in bonds with special leveraging potential,” the bank said. Just $1 billion could increase the World Bank’s lending capacity by $6 billion over a decade, it said.

The third mechanism is “extracting more value from callable capital.” This is “a commitment from our shareholders to step in with new funds” in extreme circumstances, the bank said.

Advisory panel says $3 trillion a year needed for development (9 a.m.)

To meet the needs of poverty reduction, climate-change mitigation and sustainable infrastructure development, some $3 trillion of financing per year will be needed by 2030, according to an advisory paper requested by the G-20.

“The window for action is closing fast,” a panel of economists headed by former US Treasury Secretary Lawrence Summers and NK Singh wrote in their presentation to the G-20. “The choices made now will determine prospects for growth, sustainability and inclusion for decades to come.”

It is important that multilateral development lenders leverage their balance sheets and mobilize private-sector capital, the report said. Sustainable development goals are “badly off-track” and there is an intense urgency to address problems of climate change, the panel said.

“The international development finance system should be designed to support this spending by providing $500 billion in additional external financing by 2030,” the panel said. One third of that should be in so-called concessional financing, which is ultra-low interest lending, while two-thirds should be non-concessional official funding, the group said.

© 2023 Bloomberg