US equity futures were buoyant on Tuesday as excitement over artificial intelligence fueled a rally in chipmakers and tech stocks. Treasuries advanced on hopes that Congress will pass a debt accord to head off a default.

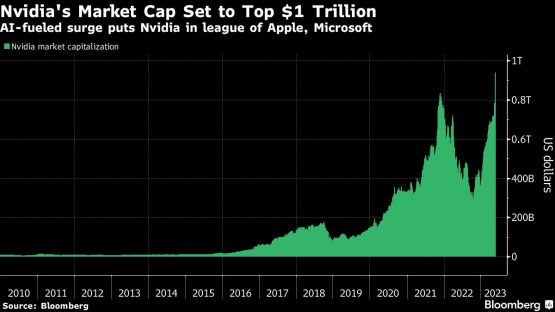

Contracts on the S&P 500 and Nasdaq 100 rose 0.6% and 1.5% respectively. Nvidia’s market value is set to surge past $1 trillion as it climbed in premarket trading after CEO Jensen Huang unveiled several AI-related products and services. Other AI-related stocks also gained, including Advanced Micro Devices Inc., Intel Corp. and Meta Platforms Inc.

Investors are hoping AI will fuel explosive demand for chips powering tools like ChatGPT, with Hang making the case on Tuesday that the technology will transcend the tech industry into everything from farming and factories to pharmaceuticals and climate change. The latest catalyst for the AI frenzy came after Nvidia forecast revenue well in excess of analysts’ estimates.

European stocks fluctuated, with tech stocks outperforming. Nestle SA and Unilever Plc fell after both announced the appointment of new chief financial officers, underscoring a changing of the guard at consumer-goods companies as inflation pressures the industry. Euro-area government bonds got a boost from data showing inflation in Spain slowed more than expected in May.

Meanwhile, investors remain deeply pessimistic about China against a backdrop of disappointing economic data. The Hang Seng China Enterprises Index neared a bear market and the offshore yuan weakened past 7.1 per dollar for the first time since November.Oil declined amid concern about faltering demand.

Lobbying for deal

Treasury yields dropped across the curve as White House and Republican congressional leaders stepped up lobbying in support of a debt-ceiling deal. Yields on short-dated bills – the most at risk of a default extended declines from recent highs. A gauge of the dollar declined for a third day.

The clock is ticking as backers of the agreement have only a week to get it through Congress before a possible June 5 default – the so-called X Day. President Joe Biden has been personally calling lawmakers to support the bill, with a vote by the House likely Wednesday, before it goes to the Senate.

“Maybe the rally has a bit further to go but it’s more buy-on-rumor, sell-on-the-news,” said Cesar Perez Ruiz, chief investment officer of Pictet Wealth Management. “As from now, we will go back to looking at economy, inflation, plus the drain of liquidity as the Treasury General Account will need to be refilled.”

Assuming Congress approves the debt deal, the Treasury Department may sell more than $1 trillion of bills through the end of the third quarter to bolster its cash balances, according to some estimates, depriving other markets of liquidity needed to maintain gains.

For Fed policymakers, details of the deal will be another consideration when they meet next month, with markets pricing in an increase of 25 basis points by July. The focus this week will be on US jobs data, due Friday, with economists expecting the addition of 200,000 payrolls in May, down from average monthly growth of about 370,000 over the past year.

“The key point for us is that US growth will continue to slow, credit tightening will continue through the second half of the year,” Wayne Gordon, executive director of commodities and FX at UBS Global Wealth Management, said on Bloomberg TV. “It may indeed lead to the Fed starting to do a more obvious pivot, potentially even starting to cut rates by the end of the fourth quarter.”

Meanwhile, a rush of 12 banks and companies are tapping Europe’s primary bond market on Tuesday, seeking to get out ahead of a potential US debt-ceiling deal that may lead to a deluge of T-bill sales. The worry is that Treasury bill sales will further raise borrowing costs. Issuers are looking to lock in lower costs of funding now, despite it being school holidays in the UK which usually leads to a slower week of bond sales.

Key events this week:

- US consumer confidence, Tuesday

- Richmond Fed President Thomas Barkin interviewed by NABE as part of monetary policy webinar series, Tuesday

- China manufacturing PMI, non-manufacturing PMI, Wednesday

- US job openings, Wednesday

- Fed issues Beige Book economic survey, Wednesday

- Philadelphia Fed President Patrick Harker has fireside chat on the global macro-economy and monetary conditions, Wednesday

- Boston Fed President Susan Collins and Fed Governor Michelle Bowman speak in Boston, Wednesday.

- ECB issues financial stability review, Wednesday

- China Caixin manufacturing PMI, Thursday

- Eurozone HCOB Eurozone Manufacturing PMI, CPI, unemployment, Thursday

- US construction spending, initial jobless claims, ISM Manufacturing, light vehicle sales, Thursday

- ECB issues report its May 3-4 monetary policy meeting. ECB President Christine Lagarde speaks at German savings banks conference, Thursday

- Philadelphia Fed President Patrick Harker speaks on economic outlook at NABE’s webinar, Thursday

- US unemployment, nonfarm payrolls, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.5% as of 8:28 a.m. New York time

- Nasdaq 100 futures rose 1.4%

- Futures on the Dow Jones Industrial Average were little changed

- The Stoxx Europe 600 was little changed

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro rose 0.3% to $1.0735

- The British pound rose 0.6% to $1.2432

- The Japanese yen rose 0.5% to 139.78 per dollar

Cryptocurrencies

- Bitcoin rose 0.8% to $27,905.75

- Ether rose 0.8% to $1,909.66

Bonds

- The yield on 10-year Treasuries declined eight basis points to 3.72%

- Germany’s 10-year yield declined six basis points to 2.37%

- Britain’s 10-year yield declined three basis points to 4.30%

Commodities

- West Texas Intermediate crude fell 1.3% to $71.71 a barrel

- Gold futures rose 0.9% to $1 980.10 an ounce

© 2023 Bloomberg