Dear reader,

Thank you for your question. You are correct in that bond prices are sensitive to interest rates. When interest rates rise, the present value of a bond will fall and vice versa. So, in theory, by investing in bonds, you can potentially capture positive returns if the interest rate drops, as the present value of the bond will increase.

From your question, I have deduced two important observations. Firstly, you may be a conservative investor and secondly, liquidity is an important investment consideration for you as you do not wish to ‘lock’ your investment into a fixed term.

From a ‘conservative investor’ point of view, the primary goal is capital protection. Stable investment growth or a regular income from the investment is usually required. In this instance, an investment in bonds can be a suitable option. Bonds are a relatively safe investment vehicle because they are backed by the government or by corporates.

RSA bonds are government bonds and are considered risk-free investments. This is because the government can use certain measures to reclaim the bond at maturity such as increasing taxes or creating additional capital.

RSA bonds can be accessed via the RSA Retail Savings Bonds Website, or the RSA Retail Savings Bonds Helpline: 012 315 5888.

It is important to note that all investments have a risk element and bonds are no different. A strong bond market is largely dependent on a sustainable and well-functioning economy.

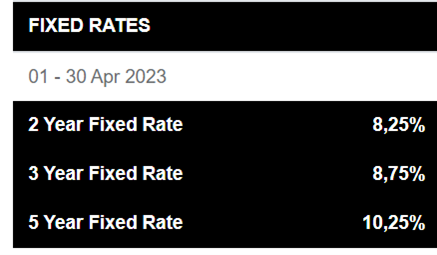

Below is a summary of the RSA fixed bond rates for April 2023:

There is also a liquidity risk with bonds, which brings me to my second observation.

Liquidity refers to the speed with which an asset can be converted into cash, without offering a discount on the value of the asset. Liquidity is important because it offers the investor the capacity to respond to life’s unforeseen events. With a direct investment into bonds, investors may get locked into fixed terms or incur a penalty for an early exit. For an investor that requires regular income or intermittent access to capital, this may pose a challenge.

An alternative approach that would solve the liquidity issue would be to use a collective investment scheme (also known as a unit trust) investment.

Unit trusts enable investors to invest in a wide range of local and international equities, bonds, property, money market instruments and their derivatives. Unit trusts can be a convenient way of investing in markets which you otherwise would find difficult to access. A unit trust portfolio is managed by suitably qualified and experienced investment managers.

Unit trust portfolios invest in a range of underlying assets. This allows the investor to diversify their investment across the various asset classes and geographic locations. Diversification can help reduce risk and enhance investment returns.

In terms of liquidity, unit trust investments offer a high level of liquidity as the capital, or any portion of the capital, is available at any time without penalties and normally takes about five working days, from the time of submitting a fully compliant withdrawal request, for the money to reflect in the investor’s account. Regular monthly withdrawals from the unit trust portfolio can also be facilitated.

There are several factors that influence the investment vehicle choice such as cost, taxation, product rules and investment returns, amongst others. A unit trust investment can be structured to include bond exposure and match your risk profile.

For a conservative investor seeking liquidity, a unit trust investment may be a viable investment option.