Most of the clothing and gadgets you buy in stores today were once in shipping containers, sailing across the ocean. Ships carry over 80% of the world’s traded goods. But they have a problem – the majority of them burn heavy sulphur fuel oil, which is a driver of climate change.

While cargo ships’ engines have become more efficient over time, the industry is under growing pressure to eliminate its carbon footprint.

European Union legislators reached an agreement to require an 80% drop in shipping fuels’ greenhouse gas intensity by 2050 and to require shipping lines to pay for the greenhouse gases their ships release. The International Maritime Organization, the United Nations agency that regulates international shipping, also plans to strengthen its climate strategy this summer. The IMO’s current goal is to cut shipping emissions 50% by 2050. President Joe Biden said on April 20, 2023, that the U.S. would push for a new international goal of zero emissions by 2050 instead.

We asked maritime industry researcher Don Maier if the industry can meet those tougher targets.

Why is it so hard for shipping to transition away from fossil fuels?

Economics and the lifespan of ships are two primary reasons.

Most of the big shippers’ fleets are less than 20 years old, but even the newer builds don’t necessarily have the most advanced technology. It takes roughly a year and a half to come out with a new build of a ship, and it will still be based on technology from a few years ago. So, most of the engines still run on fossil fuel oil.

If companies do buy ships that run on alternative fuels, such as hydrogen, methanol and ammonia, they run into another challenge: There are only a few ports so far with the infrastructure to provide those fuels. Without a way to refuel at all the ports that a ship might use, companies will lose their return on investment, so they will keep using the same technology instead.

It isn’t necessarily that the maritime industry doesn’t want to go the direction of cleaner fuels. But their assets – their fleets – were purchased with a long lifespan in mind, and alternative fuels aren’t yet widely available.

Ships are being built that can run on liquefied natural gas (LNG) and methanol, and even hydrogen is coming online. Often these are dual-fuel – ships that can run on either alternative fuels or fossil fuels. But so far, not enough of this type of ship is being ordered for the costs to make financial sense for most builders or buyers.

The costs of alternative fuels, like methanol and hydrogen fuels made with renewable energy (as opposed to being made with natural gas), are also still significantly higher than fuel oil or LNG. But the good news is those costs are starting to decline. As production ramps up, emissions will drop further.

Can tougher regulations and carbon pricing effectively push the industry to change?

A little bit of pressure on the industry can be helpful, but too much, too fast can really make things more disruptive.

Like most industries, shipping lines want standardized rules they can count on not to change next year. Some of these companies have invested millions of dollars in new ships in recent years, and they’re now being told that those ships might not meet the new standards – even though the ships may be almost brand new.

Another concern with the EU’s moves is whether it has a grasp on all the “what if” scenarios. For example, if the EU has stricter rules than other countries, that affects which ships companies can use on European routes. Any vessels that they put on routes to Europe will have to meet those emissions standards. If there’s a greater demand for products in Europe, they may have fewer vessels they could use.

I do think the change will be coming soon in the industry, but changes have to make financial sense to the shipping lines and their customers, too.

Economists have estimated that the cost of cutting emissions 50% by 2050 are anywhere from US$1 trillion to, more realistically, over $3 trillion, and full decarbonization would be even higher. Many of those costs will be passed down to charterers, shippers and eventually consumers – meaning you and me.

Are there ways companies can cut emissions now while preparing to upgrade their fleets?

There are a number of options ship companies are using now to lower emissions.

One that has been used for at least 10 years is putting higher quality paint on the hulls, which reduces the friction between the hull and the water. With less friction, the engine isn’t working as hard, which reduces emissions.

Another is slow speed. If ships run at a higher speed, their engines work harder, which means they use more fuel and release more emissions. So shippers will use slow steaming. Most of the time, ships will go slow when they’re close to shore to reduce emissions that cause smog in port cities like Los Angeles. On the open ocean, they will go back to normal speed.

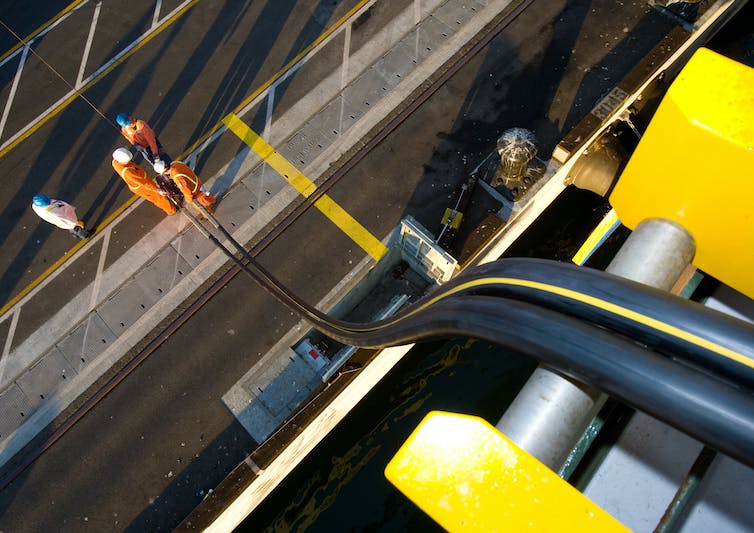

Workers at the Port of Long Beach in California prepare to plug in a container ship. Image: Tim Rue/Getty Images

Another option common in the U.S. and Europe is shutting down the ship’s engines while in port and plugging into the port’s electricity. It’s called “cold ironing.” It avoids burning more of the ship’s fuel, which affects air quality. The Ports of Los Angeles and Long Beach, where smog from idling ships has been a health concern, have been a big driver of electrification. It’s also less expensive for shipping companies than burning their fuel while in port.

As simple as those may sound, they have made huge improvements in terms of emissions, but they aren’t enough on their own.

Will a higher goal set by the IMO be enough to pressure the industry to change?

I used to work in shipping, and I know the maritime industry is a very old-school industry from centuries ago. But the industry has invested millions in new ships with the most effective technology available in recent years.

When the IMO began requiring all ships using heavy fuel in global trade to shift to low-sulphur fuel, the industry pivoted to meet the rule, even though retrofits were costly and time consuming. Many shipping lines complied by installing “scrubbers” that essentially filter the ship’s engine, and new ships were built to run on the low-sulphur fuel oil.

Now, the industry is being told the standards are changing again.

All industries want consistency so they can be confident investing in a new technology. The shipping lines will follow what the IMO says. They will push back, but they will still do it. That’s in part because the IMO supports the maritime industry, too.![]()

Don Maier is associate professor of business at the University of Tennessee

This article is republished from The Conversation under a Creative Commons licence. Read the original article.