One of the most surprising victims of the recent US banking crisis is a Swedish pension fund responsible for managing the retirement funds for a quarter of the country’s population.

For years, Alecta’s 1.2 trillion-kronor ($116 billion) portfolio included shares of Signature Bank, First Republic Bank and SVB Financial Group, the parent of Silicon Valley Bank, alongside those of large Swedish companies.

But Alecta’s nearly $2 billion loss in those US holdings, equivalent to roughly 2% of the fund’s total assets, looked to many like a serious misstep. The scandal has already triggered the departure of the chief executive officer, sparked an investigation by regulators, and is likely to force the fund to scale back its assets in the US, where its holdings include Microsoft and Google parent company Alphabet. On Thursday, the pension fund’s executives apologised for the situation.

“The investments in US banks were a failure,” said acting Chief Executive Officer Katarina Thorslund. “We shouldn’t have ended up in that place.”

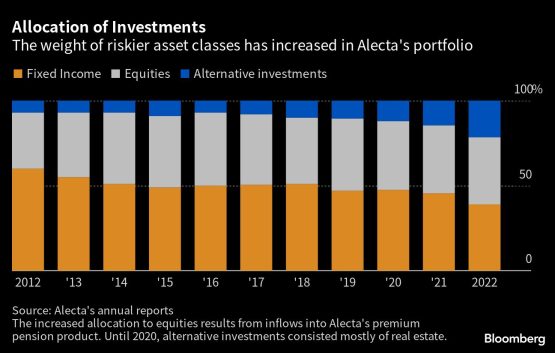

Although the limited scale of the loss makes it more embarrassing than existential, many are asking how the fund ended up in this position. The answer lies in the early 2010s, when Alecta’s leadership, stung by the ultra-low rates in the wake of financial crisis, decided to start increasing allocation toward US equities.

Alecta had long relied on index tracking, which guarantees steady returns but also hedges against huge gains. Around 2000, it began adopting a more active approach, enlisting an internal team to hand-select stocks.

In 2012, as former investment chief Per Frennberg recounted in his book about Alecta, the fund had weathered several tumultuous years during the European debt crisis and seen its returns fluctuate considerably more than those of its competitors with broader geographic investments.

That November, the board gathered to review the fund’s investment strategy. One of the conclusions, Frennberg wrote, was that to maximise profits, “risk must be used.” Alecta also decided to rebuild its US stock portfolio. Frennberg declined to comment on the fund’s US bank investments for this story.

Within two years, a fifth of Alecta’s $44 billion equity portfolio was in US companies, up from zero in 2012. The portfolio also kept getting narrower. In contrast to competitors AMF and Folksam, which hold positions in about 500 companies, Alecta concentrated its holdings in about 100 businesses. By the end of 2022, just 30 stocks accounted for three-quarters of its equity exposure.

In 2016, Alecta opened a position in Signature Bank, an outer-borough, blue-collar bank that later pivoted toward crypto. In 2019, two years after Frennberg left, it added start-up friendly SVB as well as First Republic, which specialises in private banking for wealthy clients. At the end of 2022, it was the fifth-biggest owner of SVB and First Republic, and the sixth-biggest holder of Signature, according to data compiled by Bloomberg.

In continuing to tip its hand to what would prove to be high-risk investments, Alecta’s leaders were betting on the banks’ long-term strength even as higher interest rates were eroding the value of their assets. Alecta grew its positions in SVB and First Republic last year as the stocks were getting progressively cheaper. SVB lost two thirds of its value in 2022 and First Republic slumped more than 40%.

One benefit of concentration, which grew out of an active management approach, was that the fund avoided “expensive middlemen,” Alecta has said. That also allowed it to exclude the worst underperformers, according to Frennberg.

The problem, as Alecta Chairman Ingrid Bonde acknowledged in an interview this month with Bloomberg, was that there could be “be major consequences if there is an incorrect decision — and that is what has happened.”

All falls down

Everything came to a head in March when SVB succumbed to a bank run, becoming the biggest US bank to fail since 2008. Within days, Signature was closed by regulators, and First Republic appeared to be following suit, with its shares slumping 75% by March 15 from end-of-year levels. Alecta lost all of the value in its holdings in the first two companies, and later sold its shares in First Republic, which is still in operation, at a loss.

In Sweden, the optics looked even worse as Alecta had recently exited stakes in two local lenders, Svenska Handelsbanken AB and Swedbank AB.

Three days after news broke of Alecta’s imploded bets, the pension fund was summoned by Sweden’s financial regulator for questioning. Within the company, fallout was swift. It initiated an internal probe, and put its equities chief, Liselott Ledin, on leave. On April 11, Chief Executive Officer Magnus Billing was ousted. Billing had helmed the fund for almost seven years, and Ledin was a 28-year veteran at Alecta. Ledin and Billing were not available for comment via Alecta’s press office, and Bloomberg was not able to reach them directly.

According to Dagens Industri, the country’s biggest daily business newspaper, Bonde, the fund’s chairman since 2019, has sought to scapegoat Billing and Ledin for the US bank losses — despite overseeing the fund’s deepening positions as head of the board’s finance committee. In an interview with the paper on April 5, Bonde characterised the US investments as “extraordinarily inept.”

Speaking to Bloomberg, Bonde said that she had offered to resign but was rebuffed by both the board and supervisory board. “I then felt that it was a vote of confidence and a responsibility that I had to take, and I therefore accepted it,” she said.

Alecta’s supervisory board met in Stockholm on Thursday for its regular annual meeting, where it elected Bonde for a new term as chairman until the following supervisory meeting in 2024. It also replaced two current board members and kept eight others in their current positions, essentially maintaining its status quo.

Alternative investments

Perhaps the most counterintuitive aspect of Alecta’s role in the US bank meltdown is that while some of its bets were a failure, the overall strategy has delivered. Since 2007, Alecta’s annualised return of 6.9% has meant that the fund consistently beat its peers, according to a comparison by Collectum, which decided to extend Alecta’s contract as a default pensions provider for 2.2 million people after the scandal broke out. First-quarter equity returns in 2023 were $2.8 billion, or 5.6%, and there are no signs that the fund is losing clients.

“Alecta has had a very successful model for a long time, which is based on concentrated holdings,” said Bonde. “Until 2022, we had the best returns in the entire industry for the last five to ten years.”

Hans Sterte, Alecta’s former chief investment officer who left the company last year, echoed that point at an interview at his new office at the Stockholm-based boutique consultancy firm House of Reach. The fund “made fine investments,” he asserted, characterising the strategy as having “much lower risk at the same expected return as before.”

In a statement made at the supervisory board meeting, Alecta’s General Counsel William McKechnie said that an internal investigation has concluded that the decision to invest in the US banks was “within the limits and delegated mandates provided by the board.”

In response to the fallout, Alecta announced a strategic review of its equities portfolio management, which will wrap up by this summer. The fund will likely have to choose between sticking with its strategy of betting big on small selection of lucrative US stocks or retrenching to a more conservative approach that carries less risk of bad publicity.

There are already indications of which direction it may go. In the beginning of April, the fund hinted at plans to shrink its footprint in the US, saying it will roll back risk connected to large stakes in companies far from its home market, including its US stocks. That work is now underway, spokesperson Jacob Lapidus said by phone.

At the same time, Alecta has expanded its alternative investments in areas such as real estate, infrastructure and private equity to bolster returns. In mid-2021, the fund had 12% of its assets in alternative categories. By the end of last year, that share rose to almost 22%.

Alecta’s largest alternative holding is real estate, where it is among the biggest shareholders in residential landlord Heimstaden Bostad AB — a position that Sweden’s financial regulator has already asked questions about. While officials haven’t disclosed the focus of their investigation, property values in the largest Nordic economy are currently experiencing a steep drop.

The 2.6 million customers whose retirement savings are tied up with Alecta will be watching closely in case this renewed push to diversify triggers more losses in future years.

“The money Alecta manages is pension money,” Joel Stade, an adviser for the advocacy group Swedish National Pensioners’ Organisation, said in an interview. “It’s peoples’ wages.”

© 2023 Bloomberg