Multi-asset funds are, by their nature, designed to provide clients with a ‘whole’ portfolio experience through combining a variety of asset classes to balance risk and return. Yet we often find that, when managers run these portfolios, they don’t do so on an integrated basis.

Instead, fund managers will often run multi-asset portfolio allocations along asset class lines, and manage components of the portfolio against various benchmarks. While most multi-asset portfolio managers are closely involved with the South African equity component of their funds, many outsource management of offshore equity, property and/or fixed income components to other teams or companies. They will then also assess the performance of these outsourced components against various indices.

For example, most local asset managers manage the SA equity portion against the FTSE/JSE Capped SWIX All Share Index (Capped SWIX) and assess the teams running the outsourced assets against relevant benchmarks (for example the MSCI World Index for global equity, SA Listed Property Index for local property and the All Bond Index for local bonds).

Building block approach

We believe this practice risks delivering a sub-optimal outcome to investors at certain points in market cycles. One reason is that it can be challenging to integrate all the interactive effects and the unintended correlations on a dynamic basis when combining different building blocks. We believe that there are good reasons to use a building block approach, but that the overall outcome can be improved when augmented with a dynamically fully integrated portfolio as part of that process.

PSG Asset Management is one of few local managers running a globally integrated, bottom-up selection process, offering a truly differentiated approach that holds some key advantages in helping to secure better long-term portfolio outcomes.

One reason for the tendency to outsource global allocations is the widely held belief that South African managers can’t run global portfolios successfully. Often, the reason cited for this view is that local managers simply lack the expertise or the resourcing to do so effectively, given the vast universe of investible assets available in global markets.

However, an unintended consequence of this approach is that decisions around global and local allocations are pegged to benchmark weights and exposures, rather than on the merit of individual opportunities. If one started with a blank piece of paper, equity in a South African multi-asset fund should consist of the most attractive global equities (regardless of whether they are listed in SA or not) and SA-listed shares where local asset managers have substantial experience analysing the companies and know the environment extremely well.

Top ten shares

Instead, a focus on benchmark weightings within a multi-asset portfolio can lead to the inclusion of shares that we would argue shouldn’t make the cut. Analysis by Avior indicates that only 42.7% of the Capped SWIX’s revenues are generated in South Africa. The top 10 shares by index weight account for 43% of the Capped SWIX, but on average they generate only 27.4% of their revenue locally.

If you remove the largest local banks (FirstRand, Standard Bank and Absa), the remaining seven shares on average generate less than 9% of their revenue in SA. These shares, many of which are dual-listed, should ideally compete against their global peers for inclusion in any client’s balanced portfolio, but are frequently default inclusions due to their prevalence in index benchmarks. Use of a local equity benchmark within a fund that can also invest directly offshore forces that fund to hold potentially less attractive SA-listed global shares, to the detriment of the investor.

Strong earnings potential

While we acknowledge the significant headwinds and challenges South Africa is currently facing, one should not conflate poor economic prospects with poor investment opportunities. A number of SA-focused companies have managed to grow earnings strongly over the last few years despite the economic challenges. Not only have these companies proven their resilience and ability to grow in a tough environment, but the outlook for their future earnings growth is attractive. Despite this, they are priced as though they will never grow earnings. In addition, if the South African environment proves less challenging than current sentiment suggests, these companies will perform incredibly well, with less resilient competitors having fallen by the wayside over the years.

Most of these attractive SA Inc. opportunities lie outside the top index constituents, however, making their meaningful inclusion in the typical balanced fund unlikely. Many larger asset managers may also struggle to make meaningful investments in smaller SA focused shares due to liquidity constraints.

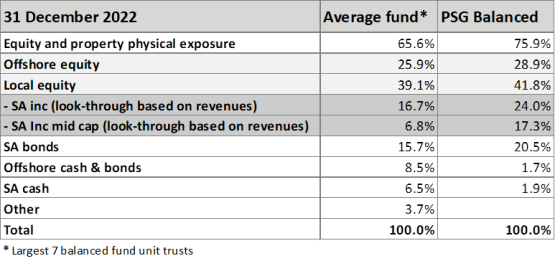

An analysis of the largest balanced fund unit trusts at the end of 2022 reveals that:

- Offshore equity allocations remain fairly low at 25.9%, despite the Regulation 28 offshore limit having been increased to 45%.

- A sizeable additional effective offshore exposure of 22.4% is obtained through locally listed shares that generate revenue globally.

- There is limited exposure to smaller SA Inc. shares (less than 7% of the portfolio on average) – we believe some of these shares are among the best investment opportunities globally due to the extremely poor SA sentiment and resultant low ratings.

The table below compares the average portfolio composition of the largest balanced funds to that of the PSG Balanced Fund. It highlights the extent to which following a globally integrated process can result in different portfolio composition and outcomes. The PSG Balanced Fund holds only two of the largest shares in the Capped SWIX (Anglo American and Standard Bank), preferring to invest directly offshore in the best global opportunities – as is evidenced by the higher direct offshore holding than average. In addition, the fund has a sizeable exposure to smaller SA Inc. shares (including for example true SA Inc. shares like Hudaco and Kaap Agri).

Positioning across the balanced fund category

Source: PSG Asset Management analysis

We believe a globally integrated investment process allows the fund manager to construct optimal portfolios and to assess SA-listed opportunities more objectively. By contrast, any limitation on investment freedom is likely to drive poorer performance over the longer term and can have a substantial impact on returns generated for clients.

PSG Asset Management has been investing globally since 2008, with a fully integrated process and portfolio managers making the instrument level investment decisions across all asset classes.

John Gilchrist is co-chief investment officer at PSG Asset Management.