Even high-end travellers are pulling back on vacation spending.

They want to pay no more than $500 a night for a hotel, and they aren’t interested in paying extra for greener or fancier options, according to the latest MLIV Pulse survey with 465 respondents, a little more than half from the US and Canada and a quarter from Europe.

This may be a reflection of diminishing consumer confidence or complaints that inflated pricing hasn’t been accompanied by a proportionate increase in service quality.

The results come during what should be one of the busiest periods for travel booking. March is when most people start to finalise summer plans and early birds get a jump on yearend holiday reservations.

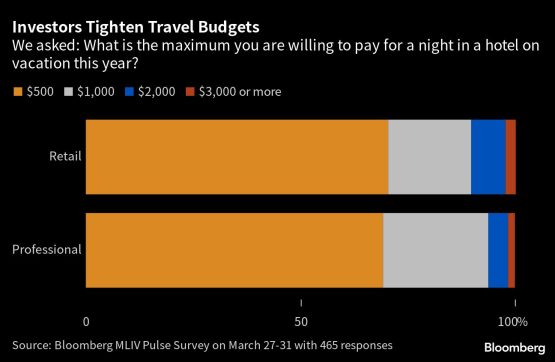

Some 69% of poll participants said their maximum budget per hotel room night was $500, while 24% were willing to spend up to $1 000. Still, 5% set their limit at $2 000, and 2% continue to entertain spending $3 000 per night or more. Respondents include traders, portfolio managers, senior managers and retail investors.

Although $500 to $1 000 per night for a room might sound high, that range eliminates the fanciest hotels in most major markets, let alone suites or larger rooms at mid-tier properties.

According to data from Google, typical prices for five-star hotels in New York City are $523 to $999 per night in April and May. In Paris that number is higher, ranging from $707 to $1 382. In St. Barts, where late spring constitutes the tail end of the season, the typical price range for a top-end hotel stretches up to $1 451.

The results of the survey suggest that luxury hotels, restaurants and airlines will face increasingly irritated consumers this summer.

Bank failures, fast inflation, elevated mortgage payments and a softening labor market, especially in high-income sectors such as tech, could see tourists keep discretionary spending in check. Travellers are watching their wallets, even after personal incomes rose faster than prices in the 12 months through February.

Limited appetite for excessive spending will probably also make some travellers balk at elevated airfares. Some airlines, like Deutsche Lufthansa AG, deliberately kept capacity in check, hoping pent-up, price-agnostic tourists would be willing to pay through their noses to get to desired destinations.

More than half of professional investors said negative economic factors, such as a recession, will undermine airline stocks in the next 12 months. Retail investors were more optimistic, with 60% predicting positive momentum in the sector.

Another trend busted by the findings of the survey is the continued growth of “bleisure” travel, in which travellers tack vacation days onto a work trip to enjoy their business destination at leisure; 62% of professional investors and 56% of retail investors said this isn’t something that they’re doing more of this year.

It may not be surprising to see that retail investors have more ongoing flexibility for remote work than banks and Wall Street firms, but it’s noteworthy that both groups are generally staying away from extended absences. In fact, a majority of respondents say their habits have recalibrated to pre-pandemic norms overall. Only 10% say they find themselves making greener travel choices—contradicting industry reports—and 50% say their spending has returned to pre-pandemic levels.

For those travelers, the days of so-called revenge spending as the pandemic passes are over, if they happened at all.

The number of people “splashing out” on their next vacation was exceedingly small: 7%. A quarter said they’d possibly upgrade things one notch. Among the 18% that said they would reduce spending, 72% were professional traders and 28% worked on the retail side.

One facet of travel that’s remained unchanged since 2019 is consumer sentiment about major aviation hubs. When asked which airport they dread the most, respondents coalesced around New York’s John F. Kennedy International Airport and London’s Heathrow, followed by Los Angeles International and Newark Liberty International Airports.

MLIV Pulse is a weekly survey of Bloomberg News readers on the terminal and online, conducted by Bloomberg’s Markets Live team, which also runs a 24/7 MLIV blog on the terminal. To subscribe to MLIV Pulse stories, click here.

© 2023 Bloomberg