The yen is making a comeback as a preferred foreign-exchange haven, after banking crises in the US and Switzerland hurt the dollar and franc’s standing as go-to assets for turbulent times.

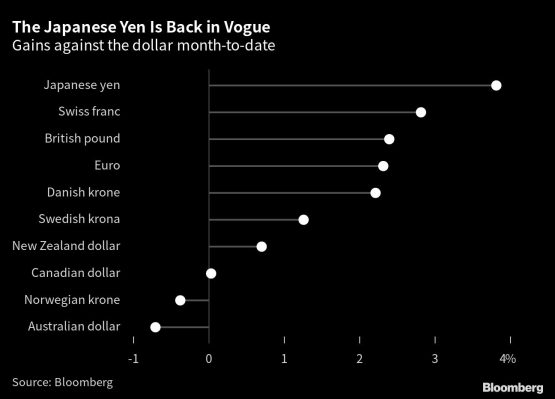

It’s a change of fortunes for the Japanese currency, which only a few months ago needed the support of policymakers to revive it from a three-decade low. It’s the world’s best-performing major currency this month and for the likes of DWS Group and Morgan Stanley, the yen is the next big trade.

“The yen was extremely weak last year, but we’re seeing a reversal of that — it’s one of the major trends that we’re seeing this year,” said Van Luu, head of currencies at Russell Investments.

The yen’s resurgence shows how sentiment can turn on a dime as the global rate-hiking cycle looks to be approaching an end. Its strength has wrong-footed hedge funds betting against the yen and Wall Street now favours it as a hedge against further shocks to the world economy.

While plunging bank stocks would normally spark a rally in the dollar, they have led to bets on the Federal Reserve reversing its higher-for-longer rates mantra, previously a money-spinner for shorting the yen. And even with the turmoil forcing a takeover of Credit Suisse Group AG, European — and to some extent Japanese — policymakers are still seen pursuing policy tightening that would favor their currencies over the greenback.

“We think bank sector stress should be more concentrated in US regionals and continue to favour the euro and yen as major beneficiaries of waning US exceptionalism,” said analysts at UBS Group AG.

Recession shelter

The prospect of a recession is leading an Allianz Global Investors fund into defensive trades including the yen, while State Street Global Advisors’ tactical portfolios favor the currency. Deutsche Bank AG’s investment arm DWS Group bets it will gain to 125 per dollar in the next 12 months, according to Bjoern Jesch, its chief investment officer.

Morgan Stanley is even more bullish, targeting about a 9% gain to 120 per dollar, since it sees investors waiting to find out just how hard the economic fallout will be. Citigroup Inc. strategists are also fans.

The yen slipped on Wednesday to trade around 132 per dollar, though it’s still up more than 3% in March. In the options market, traders with a three-month time horizon boosted their bullish yen bets to the most since 2020 this month, according to risk reversals, a gauge of expected direction for the currency.

Still, using the yen as a portfolio hedge is “extraordinarily expensive” in part down to interest-rate differentials, said James Malcolm, head of currency strategy at UBS. He still sees the yen rallying to 120 per dollar by year-end but said the way to play it is “tactically.”

And despite the haven demand, it’s unlikely to be a one-way trade. Any new sign that the Fed will keep hiking is likely to support the dollar, while there are other sources of potential yen pressure. According to RBC Capital Markets, domestic Japanese funds will drive yen selling if they don’t hedge overseas bond investments.

These real money flows could push the dollar-yen pair higher, even as the yen’s “safe haven status will dominate short-term movements,” said Adam Cole, chief currency strategist at the firm.

The fervour for the yen comes after the Swiss franc, another traditional haven, suffered its biggest one-day plunge against the dollar since 2015 when confidence in Credit Suisse reached a nadir. While the franc has since recovered some ground, investors in Switzerland have taken a knock.

“The recent financial instability risks in the US and Europe have increased the likelihood of an economic slowdown,” said Nomura International Plc currency strategist Yusuke Miyairi. “We believe the yen will benefit as a relative ‘safe haven’ currency more easily.”

Yield relief

In Japan, the return of inflation has also led to bets on yen appreciation. Traders continue to speculate the Bank of Japan will eventually normalise policy, after years of suppressing rates near zero.

The BOJ’s super-easy policy, flying in the face of global rate hikes, was one of the reasons the yen lost its haven status last year, slumping more than 24% against the greenback at one point.

The surge in interest in the yen, whichever way it goes, is likely to mean greater swings in the currency.

“With the Fed nearing the end of its rate hiking cycle, that’s likely to be a major driver of market action in the dollar against the yen — Japan may become the land of rising volatility,” said Tanvir Sandhu, chief global derivatives strategist at Bloomberg Intelligence.

© 2023 Bloomberg