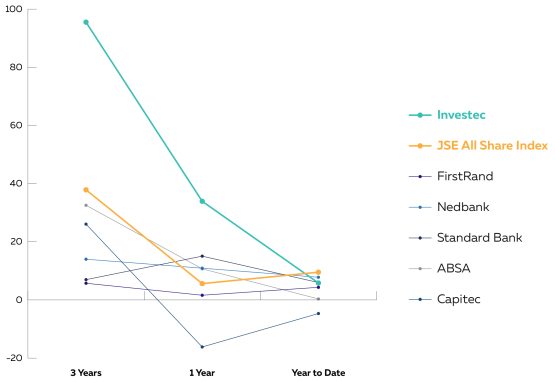

As the rally in South Africa’s banking stocks continues, Investec has seen its share price growth overtake not only its peers but the benchmark JSE All Share Index (Alsi) as well.

Over the past three years, Investec’s share price has skyrocketed more than 95%, leading the gains seen in the banking sector by far and surpassing that of the JSE Alsi, which saw its value rise by nearly 38% over the same period.

Behind Investec is Absa (32.54%), Capitec (26.06%) and Nedbank (14%), with Standard Bank and FirstRand lagging behind with single-digit growth of 6.97% and 5.73% respectively.

Source: Moneyweb

Compare the performance of up to 5 instruments, with Moneyweb’s Comparison Tool

Kokkie Kooyman of Denker Capital tells Moneyweb Investec was previously “mispriced” and has been experiencing a rerating following its separation from its investment arm, now Ninety One, with the efforts of CEO Fani Titi and his management team starting to show.

Going back to basics pays off

Titi was appointed CEO in 2018. Prior to this, Investec was not well managed, according to Wayne McCurrie of FNB Wealth and Investments.

“They were maybe too aggressive, they maybe expanded too quickly, and when he [Titi] took over, he said ‘We’re going back to basics … we’re going to cut unprofitable businesses, we’re not going to worry about prestige’ – and he’s doing a very successful job,” says McCurrie.

However, despite its good earnings, uncertainty remains in its UK business, where the economy faces threats of economic stagnation, says Kooyman.

“It’s still cheap, it’s a good buy, but the problem now is that about half of its assets sit in the UK, which is facing a recession. So there’s a lot of uncertainty about the quality of the loan book in the UK.”

Like many central banks in major economies, the South African Reserve Bank brought on a fierce fight against runaway inflation, raising interest rates by a cumulative 375 basis points since September 2021 when it launched its hiking cycle.

Read: Bank stocks took a hammering from Phala Phala saga

Although rising interest rates make the cost of borrowing more expensive, piling more pressure on already strained consumers, banks have benefitted.

Generally, says Intellidex senior banks analyst Nolwandle Mthombeni, banks benefit from the endowment effect of operating in a high-interest-rate environment that is providing a fillip to their topline earnings.

“Less so to banks like Capitec, because they are less sensitive to interest rates because they have fixed assets … none of the loans they do are geared to the interest rates, because they’re fixed,” she says.

“Unfortunately, Capitec is the one which will have basically very little benefits from the higher rate.”

Read: Capitec still shaking up the establishment

Of all the banks, Capitec’s stock price over one year moved in the opposite direction to its peers, losing over 16% of its value.

Source: Moneyweb

In comparison, Investec gained more than 33% over the one-year period, while Standard Bank’s share rose 15%, Nedbank and Absa saw their share prices increase 11%, and FirstRand’s share saw muted growth of 1.6%.

“Capitec’s earnings were very good, but it disappointed the market a bit with a few smaller things, by increasing provisions more than the market anticipated,” says Kooyman.

According to Mthombeni, following the market’s disappointment over Capitec and the change in its growth profile, investors are pricing in lower earnings.

“That is one of the main reasons over the last year Capitec has been an underperformer, on a one-year basis – it’s down more than 15%, yet all the other banks are up,” she says.

McCurrie expects banks to continue to deliver robust sets of earnings over the next six to 12 months, saying their margins are “significantly enhanced”.

“So far there’s no real threat of bad debts in the system,” he adds.

“That could happen in the future, [but] at the moment the bad debts look quite well contained and the banks are more than adequately capitalised; there’s no threat to a dividend.”