Asian shares advanced with US and Europe futures on Thursday, extending a rally on Wall Street after Federal Reserve Chair Jerome Powell said the central bank had made progress in its battle against inflation.

A benchmark of Asian stocks climbed as much as 1%, with Hong Kong-listed technology companies among the top performers. The picture in was more mixed in Japanese and mainland China markets.

The dollar continued its decline against both Group-of-10 and emerging-markets currencies. A gauge of the greenback’s strength was at the lowest level since April as global investors position for a potential peak in US interest rates.

Treasury yields held a drop from the US session of about 10 basis points in key maturities across the 2-10 year zone. Australian and New Zealand bonds broadly tracked the closing moves in Treasuries Wednesday. Japan’s benchmark 10-year yield steadied two basis points below the central bank’s 0.5% ceiling

Powell’s comment that the “disinflation process has started” suggested that the aggressive tightening cycle is starting to have its desired effect of reducing the pace of price growth, helping the S&P 500 jump more than 1%. The tech-heavy Nasdaq 100 outperformed major benchmarks, closing at the highest since September.

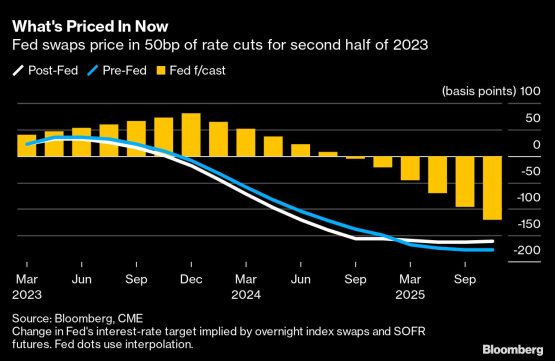

Positioning in US swaps markets assumes the Fed is getting closer to cutting rates as traders bet that economic conditions are likely to keep it from the additional rate increases that policymakers still anticipate.

“I think market took what Powell didn’t say and ran with it,” said Karen Jorritsma, head of Australian equities at RBC Capital Markets. “He was pretty clear that he would stay on a restrictive stance as long as was needed and that some signs are coming through in the data although unemployment was at a 50-year low.”

Adding to the positive tone for risk taking, in US after-hours trading, Meta Platforms Inc. surged, leading social-media stocks higher, after reporting better-than-expected sales during the holiday quarter.

“US sector performance was consistent with the big rally in fixed income across the curve, which for Asia-Pacific should support duration proxies like tech and soft landing beneficiaries like consumer discretionary,” said Chamath De Silva, senior portfolio manager for BetaShares Holdings.

The focus in Asia is also on the Adani Group’s crisis as the fallout from a short-seller’s research report leads to ever more intense pressure on the indebted conglomerate’s securities.

Bonds of the Indian billionaire Gautam Adani’s flagship firm plunged to distressed levels in US trading, and the company abruptly pulled a record domestic stock offering after shares in the Adani group suffered a $92 billion crash.

Elsewhere in markets, oil staged a partial rebound after slumping on Wednesday as the US dollar fell and traders weighed the potential for better demand in China. Gold edged higher after reaching a nine-month high in the wake of Fed decision.

Bitcoin hit the highest since August as investors interpreted Federal Reserve Chair Jerome Powell’s comments about progress on inflation as a sign that a less harsh monetary policy backdrop lies ahead.

Later Thursday, central banks in Europe will be center stage with both the European Central Bank and the Bank of England expected to raise rates by half a percentage point each.

Key events this week:

- Eurozone ECB rate decision, President Christine Lagarde press conference, Thursday

- UK BOE rate decision, Thursday

- US factory orders, initial jobless claims, US durable goods, Thursday

- Earnings Thursday include: Alphabet, Apple, Amazon, Qualcomm and Deutsche Bank and Santander

- Eurozone S&P Global Eurozone Services PMI, PPI, Friday

- US unemployment, nonfarm payrolls, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.2% as of 11:34 a.m. Tokyo time. The S&P 500 rose 1.1%

- Nasdaq 100 futures rose 0.8%. The Nasdaq 100 rose 2.2%

- Japan’s Topix fell 0.3%

- Australia’s S&P/ASX 200 rose 0.2%

- Hong Kong’s Hang Seng rose 0.3%

- The Shanghai Composite was little changed

- Euro Stoxx 50 futures rose 0.7%

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro rose 0.3% to $1.1020

- The Japanese yen rose 0.3% to 128.53 per dollar

- The offshore yuan was little changed at 6.7174 per dollar

- The Australian dollar was little changed at $0.7143

Cryptocurrencies

- Bitcoin rose 1% to $23,907.55

- Ether rose 2.3% to $1,672.95

Bonds

- The yield on 10-year Treasuries declined two basis points to 3.40%

- Japan’s 10-year yield was steady at 0.48%

- Australia’s 10-year yield declined eight basis points to 3.49%

Commodities

- West Texas Intermediate crude rose 0.7% to $76.97 a barrel

- Spot gold rose 0.2% to $1 953.46 an ounce

© 2023 Bloomberg